year

2024

No. of pages

120

Target group

Companies that provide electrical installation services, but they may also do other activities in addition (HVAC, plumbing, etc.). Most interviews are conducted with owners/ directors or purchasers of these companies.

Key research topics

Smart and connected products

Methodology

Based on 807 successful quantitative telephone interviews in native languages

Country scope

United Kingdom, Germany, France, Poland, Belgium, the Netherlands and Spain

Deliverables

Full report in pdf or ppt covering all 7 countries, support from a key account manager in case of questions

Publication frequency

Quarterly

Price

3,250 Euro

What is this report?

This report provides a comprehensive view of the attitudes of installers toward smart solutions, specifically among electrical installers and their clients. In the report, you will find insights into the installers' experiences with installing smart products and the willingness of end users to invest in such solutions, as well as their motivations and pain points. This information can help you shape, refine, or develop your business strategies for engaging with electrical installers. The research is based on quantitative telephone interviews conducted with 807 electrical installers, but they may also do other activities in addition (HVAC, plumbing, etc.). These interviews were conducted across the 7 major European markets.

Why do you need this report?

This report will provide valuable insights into the perspectives of electrical installers on smart building products and their installation. These insights will be especially valuable for manufacturers targeting this group, as the information in the report can either validate current business strategies or lay the foundations for new ones. Furthermore, understanding the attitudes and willingness of installers and end users to invest in smart building products will facilitate fact-based internal discussions without the need for custom research.

How was the research conducted?

This report is based on 807 successful quantitative telephone interviews with installers, conducted in the native language in the United Kingdom, Germany, France, Poland, Belgium, the Netherlands and Spain. The report is based on a representative sample of installers, with companies that provide electrical installation but they may also do other activities in addition (HVAC, plumbing, etc.). Most interviews are conducted with owners/ directors or purchasers of these companies. This research is conducted quarterly with reports covering different key marketing topics like media orientation, BIM, prefab, sustainability and many more.

What is included in this report?

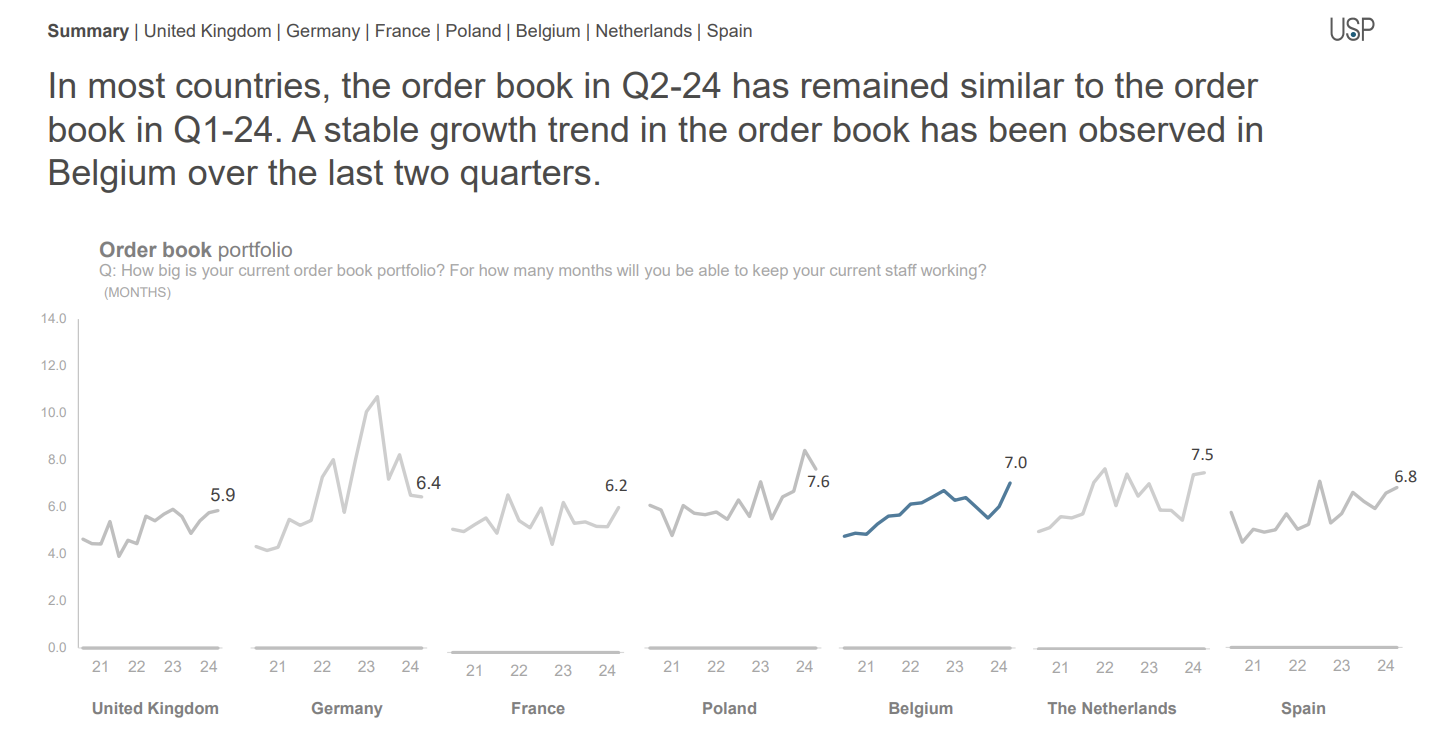

The primary focus of this research is to provide key insights into the state of smart building products in the electrical installation sector. The study also offers insights into the main drivers and reasons why end users don’t choose smart building products and automatization for their homes. It also highlights key differences among the 7 European countries covered and provides other essential insights for each country. The report also includes a detailed view of the turnover and order book developments of the installers, along with background information on their company size and other relevant details.

Key questions answered

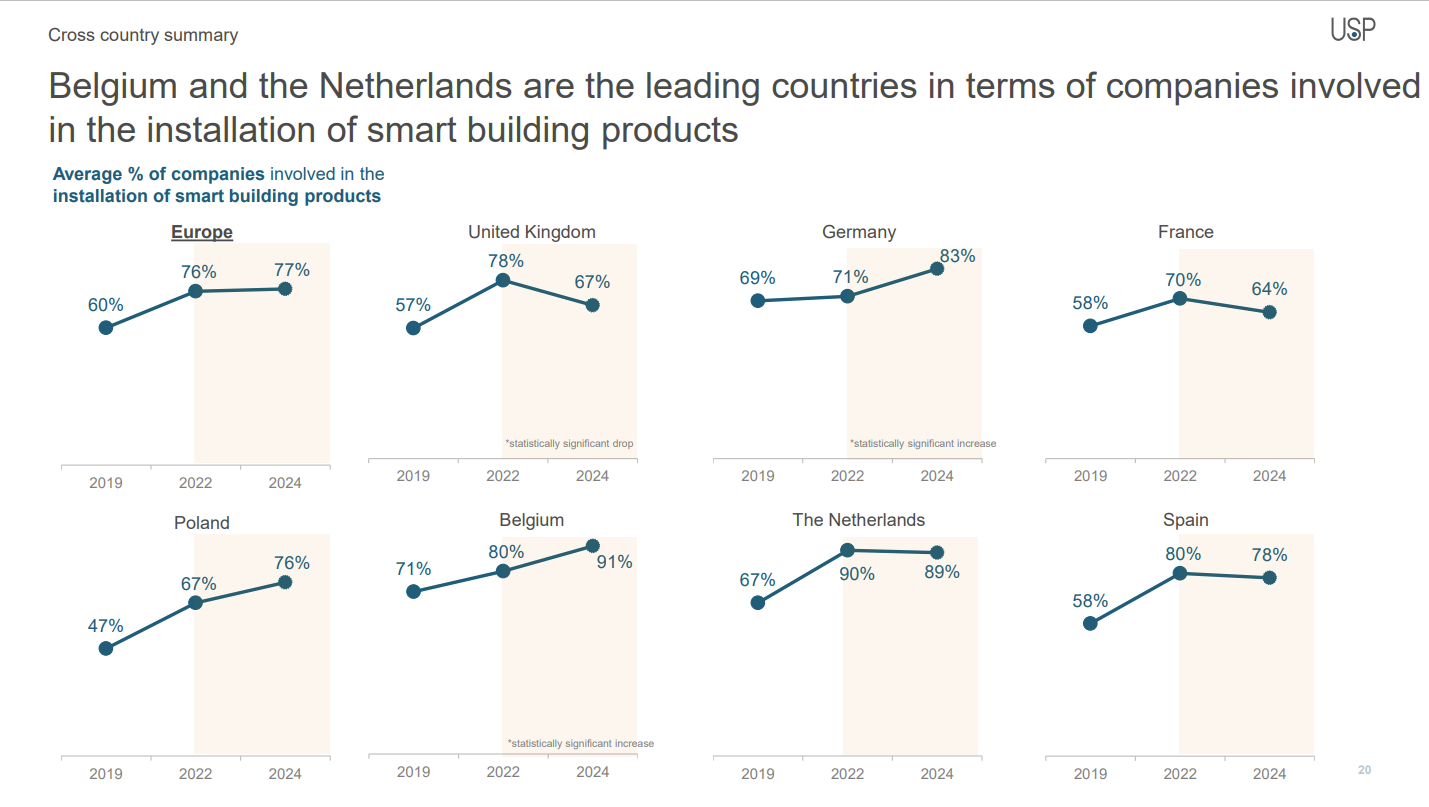

To what extent are European companies involved in the installation of smart building products by country?

What is the attitude of electrical installers toward the installation of smart building products in each European country?

What is the current demand for the installation of smart building products in each country?

Which smart building products are predominantly installed and requested by end users?

What is the primary driver for electrical installers when installing smart building products?

What is the main reason electrical installers choose not to work with automation and smart building products?

Table of content

- Key takeaways

- Business development

- Smart and connected products

- Cross-country summary

- United Kingdom

- Germany

- France

- Poland

- Belgium

- The Netherlands

- Spain

Frequently asked questions

-

How was the overall share of European electrical installation companies working with smart products?

Compared to 2022, the overall share of European electrical

installation companies working with smart products has remained steady. Notable increases are seen in Germany and Belgium. In contrast, the UK has experienced a decline, likely due to high failure rates with smart meters (display issues, slow problem resolution, first generation meter compatibility issues, etc.)

-

How did the turnover develop throughout Q2 2024?

Q2 2024 was positive for electrical installers in all countries, with more optimistic expectations for Q3 2024.

-

How much experience do installers have in smart solution industry?

The vast majority of installers are well experienced with smart products, but most of them still perform up to 5 smart product installations per month.

-

What are the most installed smart building solutions among European countries?

On a European level, lighting solutions are the most installed smart building systems. Most installers find installing smart products more complicated than traditional electrical products.

-

Which brand is the leader in smart building solutions?

On a European level, Schneider Electric has been mentioned most often as the best in class for smart products.

Neem contact met ons op

Zend ons een bericht

Neem dan contact op met ons kantoor of vul het contactformulier in, dan nemen onze specialisten contact met u op.

TELEFOON

+31 10 2066900ADDRESS

Max Euwelaan 51

3062 MA Rotterdam