year

2023

No. of pages

106

Target group

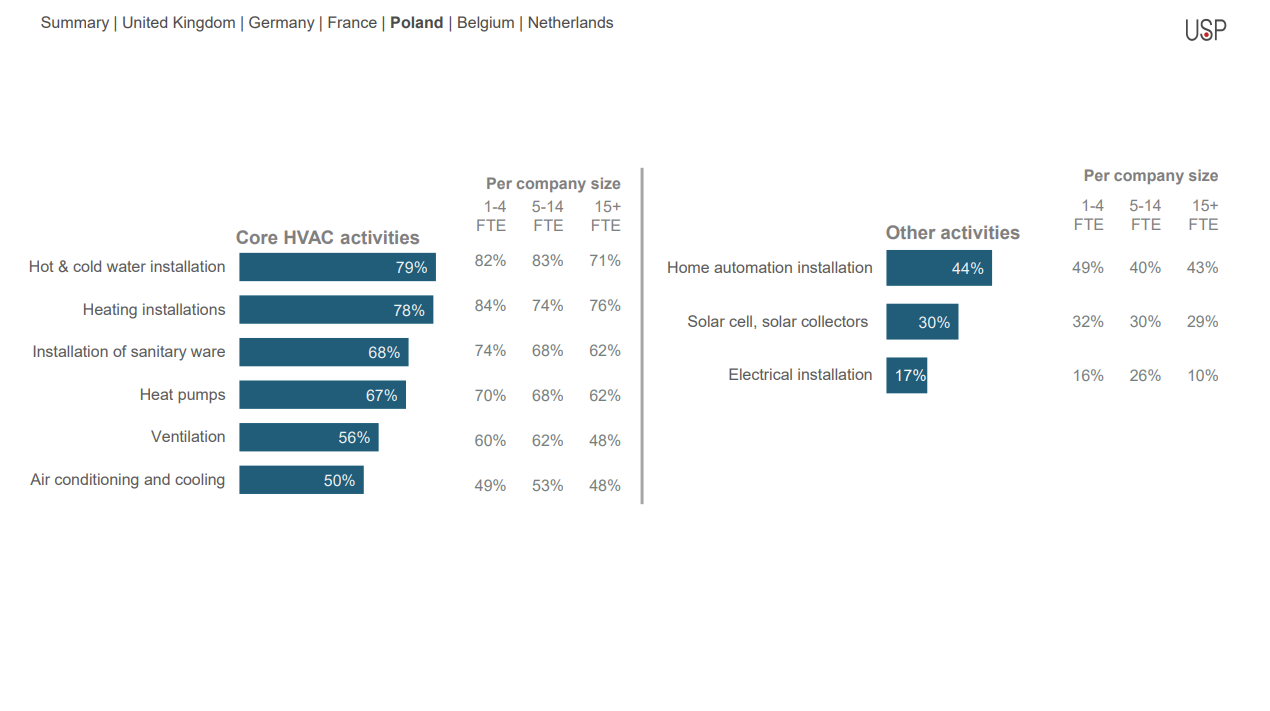

HVAC installers and plumbers, companies that provide HVAC installation services, but they may also do other activities in addition (Electrical installation etc.)

Key research topics

Purchase channels

Methodology

Based on 697 successful quantitative telephone interviews in native languages

Country scope

United Kingdom, Germany, France, Poland, Belgium and Netherlands

Deliverables

Full report in pdf or ppt covering all 6 countries, support from a key account manager in case of questions

Publication frequency

Quarterly

Price

2,800 Euro

What is this report?

This report provides a comprehensive view of the attitudes of installers toward purchase channels, specifically among HVAC installers and plumbers. In the report, you will find insights into buying behaviour, which channels are mostly used, which are growing, and whether online channels are gaining acceptance. This information can help you shape, refine, or develop your business and marketing strategies for engaging with HVAC installers and plumbers. The research is based on quantitative telephone interviews conducted with 697 HVAC installers and plumbers—companies that provide HVAC installation services while also engaging in other activities, such as electrical installation, among others. These interviews were conducted across the six major European markets. To preview a sample of this report, click here

Where can I see how this report looks like?

To make your purchase decision easier, we’ve prepared a sample of the report for you — to preview it, click here.

Additionally, you can contact us for a free demonstration where we will answer all your questions and help you select the most suitable report for your business. To contact us, click here.

Why do you need this report?

This report will provide valuable insights into the preferences of HVAC installers and plumbers regarding the purchase channels they use for professional purposes. These insights will be especially valuable for manufacturers, wholesalers, and retailers targeting this group, as the information in the report can either validate current business and marketing strategies or lay the foundations for new ones. Furthermore, understanding the attitudes and willingness of installers and end-users to invest in smart building products will facilitate fact-based internal discussions without the need for custom research.

How was the research conducted?

This report is based on 697 successful quantitative telephone interviews with installers, conducted in the native language in the United Kingdom, Germany, France, Poland, Belgium

and the Netherlands. The report is based on a representative sample of installers, with companies that provide HVAC installation services, but they may also do other activities in addition (Electrical installation etc.). Most interviews are conducted with owners/ directors or purchasers of these companies. This research is conducted quarterly with reports covering different key marketing topics like media orientation, BIM, prefab, sustainability and many more.

What is included in this report?

The primary focus of this research is to provide key insights into the preferable purchase channels among HVAC installers and plumbers. The study also offers insights into their purchasing behaviour, whether they tend to choose more traditional ways of buying or are leaning towards online purchases. It highlights key differences among the 6 European countries covered and provides other essential insights for each country. The report also includes a detailed view of the turnover and order book developments of the installers, along with background information on their company size and other relevant details.

Key questions answered

What is the turnover for European HVAC installers and plumbers in the last quarters and Q3 2023?

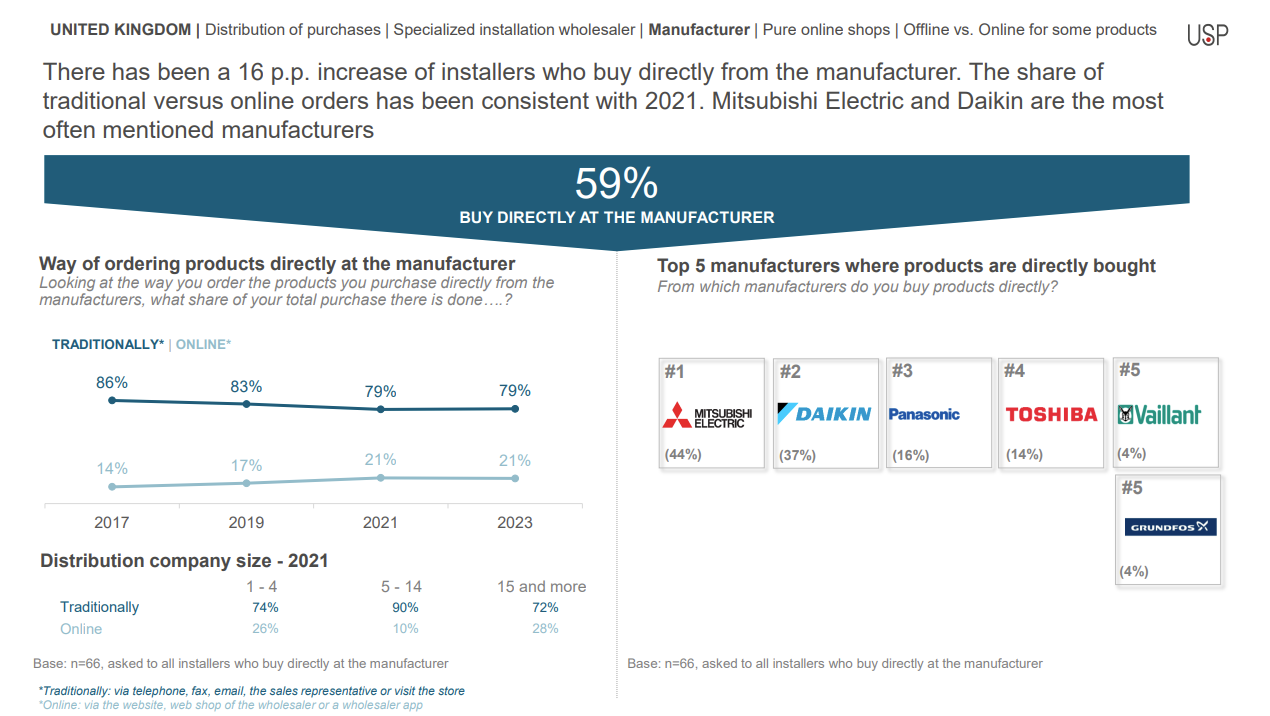

What is the main point of purchase for HVAC installers and plumbers?

Do HVAC installers tend to pick up products, or do they prefer them to be delivered?

What is the attitude of HVAC installers and plumbers toward online purchases?

In which countries do HVAC installers and plumbers make the most online purchases?

What are the differences in purchase behaviour among HVAC installers and plumbers in the United Kingdom, Germany, France, Poland, Belgium, and the Netherlands?

Table of content

- Key takeaways

- Profile of the Mechanical installer

- Business development

- Purchase channels

- Cross-country summary

- The United Kingdom

- Germany

- France

- Poland

- Belgium

- The Netherlands

Frequently asked questions

-

What is the main source of purchase for European HVAC installers and plumbers, and where do they spend the most money on installation-related products for their daily jobs?

Declines can be seen in the share of wallets of traditional wholesalers, although it remains the most dominant purchase channel in all countries. A considerable share of installers buys from pure online shops, but their “share of wallet” is relatively small in most countries.

-

In which European countries do HVAC installers and plumbers tend to buy their products online the most?

German and Dutch installers are frontrunners in the share of purchases ordered online from traditional specialized wholesalers.

-

Do HVAC installers and plumbers tend to pick up products they ordered from traditional specialized installation wholesalers, or do they prefer them to be delivered?

HVAC installers and plumbers prefer for the products to be delivered to them. The highest share of installers that have all their orders delivered is found in Germany (85%) and the Netherlands (83%). These installers will be less exposed to point-of-purchase marketing materials or the recommendations of the salesperson behind the counter.

-

How much do HVAC installers and plumbers use pure online shops for their product purchases?

The UK (49%) and Dutch (40%) installers lead in the usage of pure online shops, while Dutch installers spend the most money via this purchase channel. Purchases through online shops are increasing in all countries; usage is increasing more than the share of the wallet.

-

What is the turnover outlook for the last quarters and Q3 2023?

Poland continues to have a negative turnover balance in Q3-23. All other countries have a positive balance and positive expectations for Q4, although the turnover balance has decreased in the Netherlands and Belgium.

Contact us

Send us a message

Please contact our office or fill in the contact form and our specialists will contact you.

PHONE

+31 10 2066900ADDRESS

Max Euwelaan 51

3062 MA Rotterdam