year

2022

No. of pages

93

Target group

Consumers

Key research topics

DIY vs. DIFM

Methodology

Based on 6.608 successful online interviews in native languages

Country scope

Germany, the United Kingdom, France, Netherlands, Belgium, Poland, Spain, Italy, Denmark, Sweden and Austria

Deliverables

Full report in pdf or ppt covering all 11 countries, support from a key account manager in case of questions

Publication frequency

Quarterly

Price

3,500 Euro

What is this report?

This report provides a comprehensive overview of the home improvement industry, specifically tailored to European consumers. Within this report, you will gain insights into how customers perceive improvements in their households, their primary motivations, and the significance of sustainability in their decisions. This report not only looks at Do It Yourself (DIY) versus Do It For Me (DIFM), but we also look closely at the planned and expected home improvement jobs that consumers will have in 2023. Additionally, the report delves into the economic landscape of the home improvement sector. This data can assist you in refining, enhancing, or developing your business, communication, and marketing strategies for the DIY consumer market in Europe. Our research is based on online interviews conducted with 6,608 European consumers hailing from Germany, the United Kingdom, France, the Netherlands, Belgium, Poland, Spain, Italy, Denmark, Sweden, and Austria. To preview a sample of this report, click here

Where can I see how this report looks like?

To make your purchase decision easier, we’ve prepared a sample of the report for you — to preview it, click here.

Additionally, you can contact us for a free demonstration where we will answer all your questions and help you select the most suitable report for your business. To contact us, click here.

Why do you need this report?

This report will offer valuable insights into the trends regarding the choice between DIY and hiring professionals for home improvement in European households. These insights will be especially beneficial for DIY stores and manufacturers targeting consumers in this market. With this information, businesses can optimize their strategies in terms of marketing and communication to align with the current market demand. Moreover, understanding customers’ behaviour, preferences, and attitudes regarding DIY vs. DIFM will facilitate data-driven internal discussions, eliminating the need for custom research.

How was the research conducted?

This report is based on 6.608 successful online interviews with consumers in European countries: Germany, the United Kingdom, France, Netherlands, Belgium, Poland, Spain, Italy, Denmark, Sweden and Austria. This research is conducted quarterly with the reports covering different key topics in the home improvement industry like consumer orientation, DIFM vs. DIY, sustainability, branding, digitalisation of the sector, purchase channels and many more.

What is included in this report?

The primary focus of this research is to provide key insights into European customers’ preferences for DIY (Do-It-Yourself) or DIFM (Do-It-For-Me) approaches in home improvement. It delves into consumer attitudes, examining the main factors influencing their choice between DIY and professional services. The report also covers the planned and expected home improvement projects that consumers intend to undertake in 2023. Furthermore, the report covers home improvement trends across 11 European countries, and the study explores consumers’ product and tool preferences for these projects. This comprehensive research offers a deep understanding of the current status and emerging trends within the dynamic home improvement industry. It also examines the economic development of the DIY sector and provides insights into consumer behavior in the near future.

Key questions answered

What type of products and tools are mostly used in home improvement jobs in European households?

What are the current DIY trends?

How much are people in European households willing to house improvement jobs themselves?

When do people in European households choose to hire professionals to do house improvement jobs?

What is the main reason people in Europe choose the DIY or DIFM approach?

Table of content

- Key insights

- European developments

- DIY vs. DIFM

- European overview

- Country overview

- Austria

- Belgium

- Denmark

- France

- Germany

- Italy

- The Netherlands

- Poland

- Spain

- Sweden

- The UK

- Home improvement per category

- Paint

- Adhesives

- Adhesives/glues

- Sealants

- Power tools

Frequently asked questions

-

How many European households plan to do home improvement jobs by themselves?

Approximately a third of European households plan to do the home improvement jobs themselves, with DIY being most frequently expected in the UK and France.

-

Why do European households hire professional help for home improvement jobs?

Slightly more than half of European households list a lack of skills as the primary reason to hire professional help for home improvement jobs in the next two years.

-

When people from European households decide to do the house improvement jobs themselves, what is the main driving factor?

Slightly less than half of people from European households list their affinity with DIY as the biggest reason for doing more home improvement jobs themselves in the next two years.

-

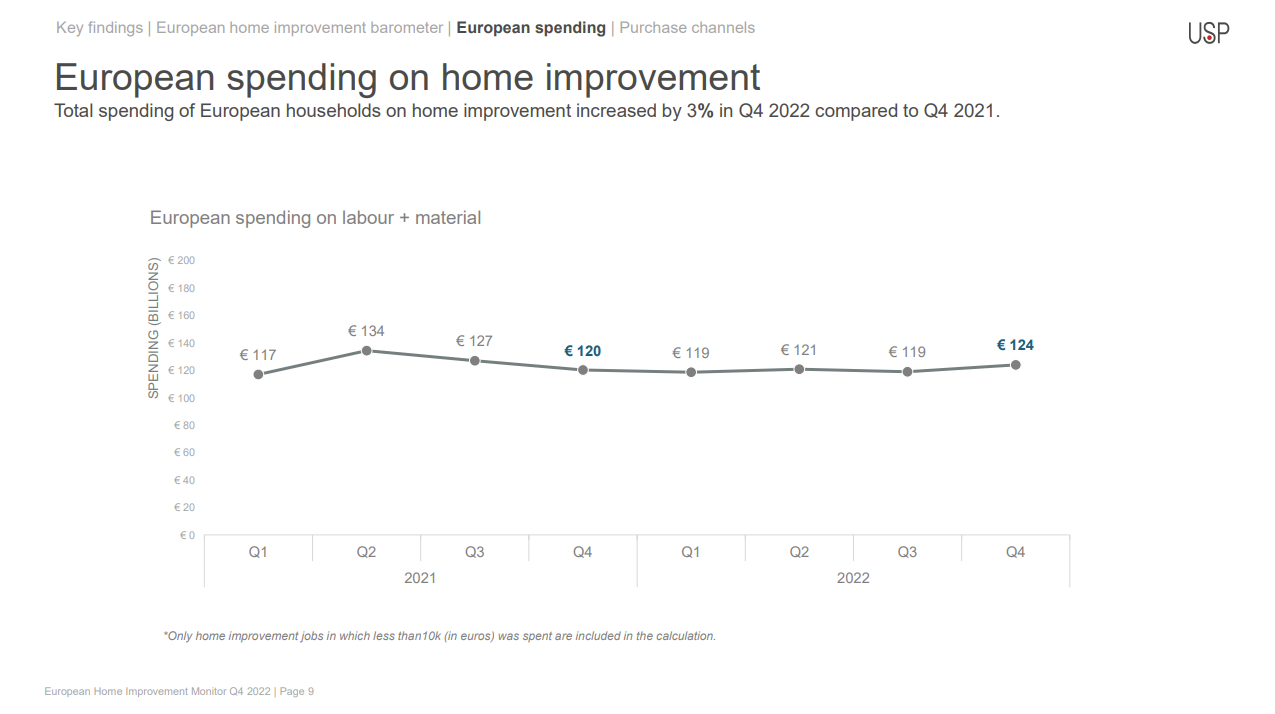

Do European households expect to spend more on home improvement in 2023?

More spending on home improvement jobs is expected in 2023, with the biggest spending increase being expected in Italy, Spain and Poland.

-

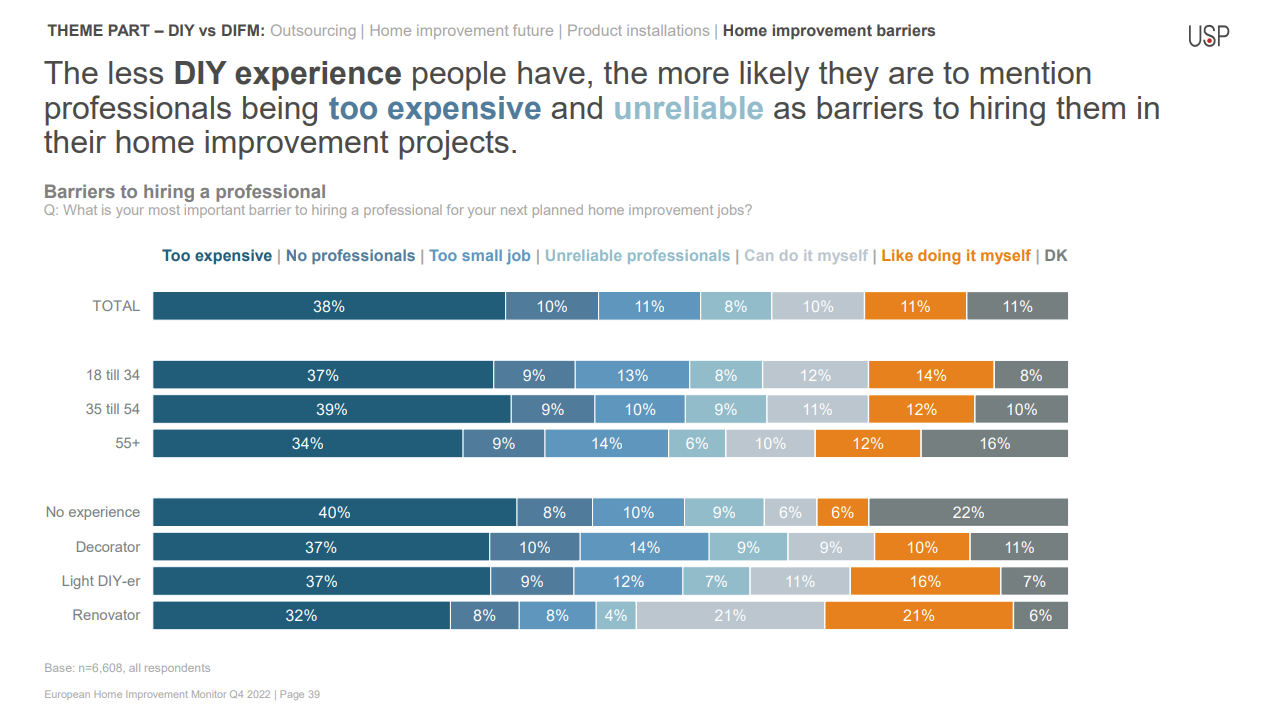

What is the main barrier to hiring professionals to do house improvement jobs among European households?

The main barrier to hiring professionals is them being too expensive, which is especially the case in Belgium, Germany and France.

Contact us

Send us a message

Please contact our office or fill in the contact form and our specialists will contact you.

PHONE

+31 10 2066900ADDRESS

Max Euwelaan 51

3062 MA Rotterdam