year

2022

No. of pages

133

Target group

Architectural companies, excluding companies with only 1 employee

Key research topics

The brands architects recognize and use the most

Methodology

Based on 937 successful quantitative telephone interviews in native languages

Country scope

Germany, United Kingdom, France, Netherlands, Belgium, Poland, Spain, Italy

Deliverables

Full report in pdf or ppt covering all 8 countries, support from a key account manager in case of questions

Publication frequency

Quarterly

Price

2,000 Euro

What is this report?

This report offers a comprehensive overview of the state of brands within the construction industry, focusing specifically on European architects. Within the report, you will discover brand awareness and usage statistics categorized by country and product category. This information can assist you in refining, enhancing, or developing your communication strategy targeted at architects. Our research is based on quantitative telephone interviews conducted with 937 registered architects, each representing firms with 1 or more employees, distributed across the eight major European markets. To preview a sample of this report, click here

Where can I see how this report looks like?

To make your purchase decision easier, we’ve prepared a sample of the report for you — to preview it, click here.

Additionally, you can contact us for a free demonstration where we will answer all your questions and help you select the most suitable report for your business. To contact us, click here.

Why do you need this report?

This report will provide key insights into the preferable brands in the construction industry among European architects. These insights will be particularly valuable for manufacturers, and wholesalers targeting this group, as with the insights in the report brands can measure their “temperature” and have a quick glimpse into their positioning on the market. Furthermore, understanding architects behavior and their brand preference will facilitate fact-based internal discussions without the need for custom research.

How was the research conducted?

This report is based on 937 successful quantitative telephone interviews with architects, conducted in the native language in Spain, Italy, France, Belgium, the Netherlands, the UK, Germany and Poland. The report is based on a representative sample of architects, with companies with less than 1 employee being excluded. This research is conducted quarterly with the reports covering different key marketing topics like media orientation, BIM, prefab, sustainability and many more.

What is included in this report?

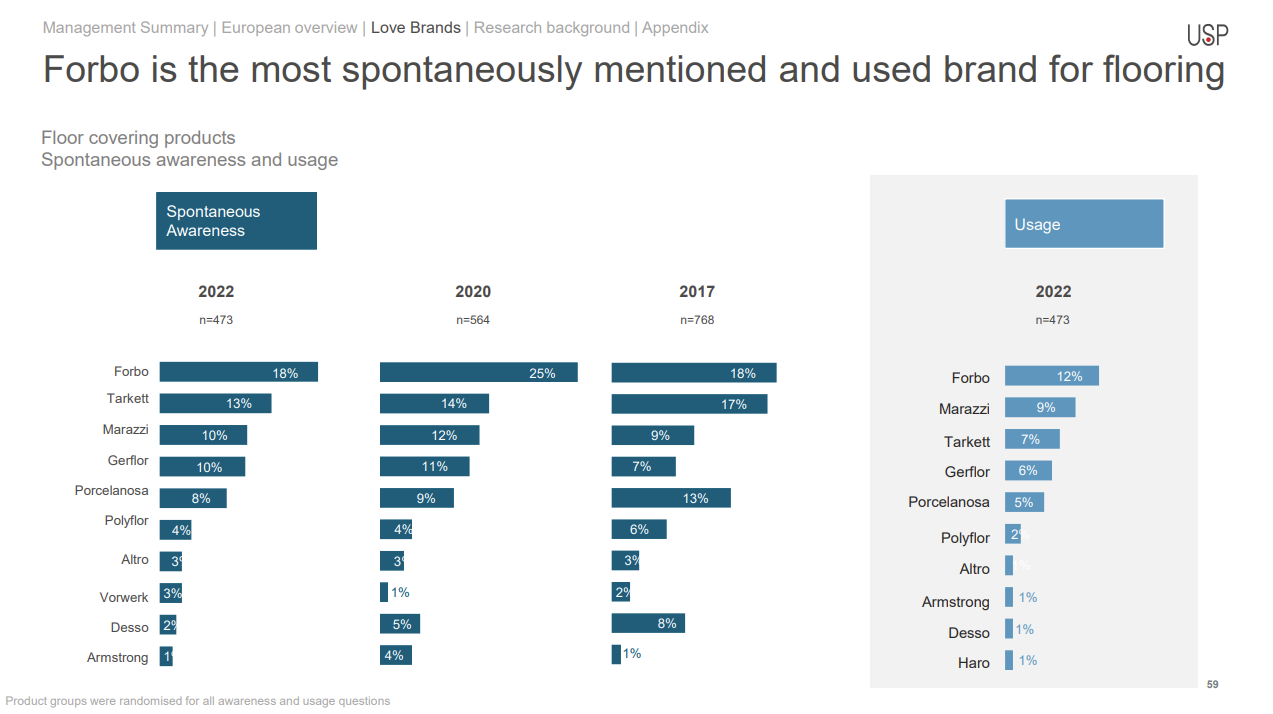

The primary focus of this research is to provide key insights into the brand preference among European architects. The study also offers insights into 10 different categories: leading manufacturers in the construction industry, floor and wall tiles, insulation materials, floor covering products, facade cladding, bathroom products, daylight solutions, lighting systems and solutions, sun cladding and waterproofing solutions. The report measured brand awareness and the brand usage per category. It highlights key differences among the 8 European countries covered and provides other key insights. The report also includes a detailed view on the turnover and orderbook developments of the architects and background information on their company size, and other relevant information.

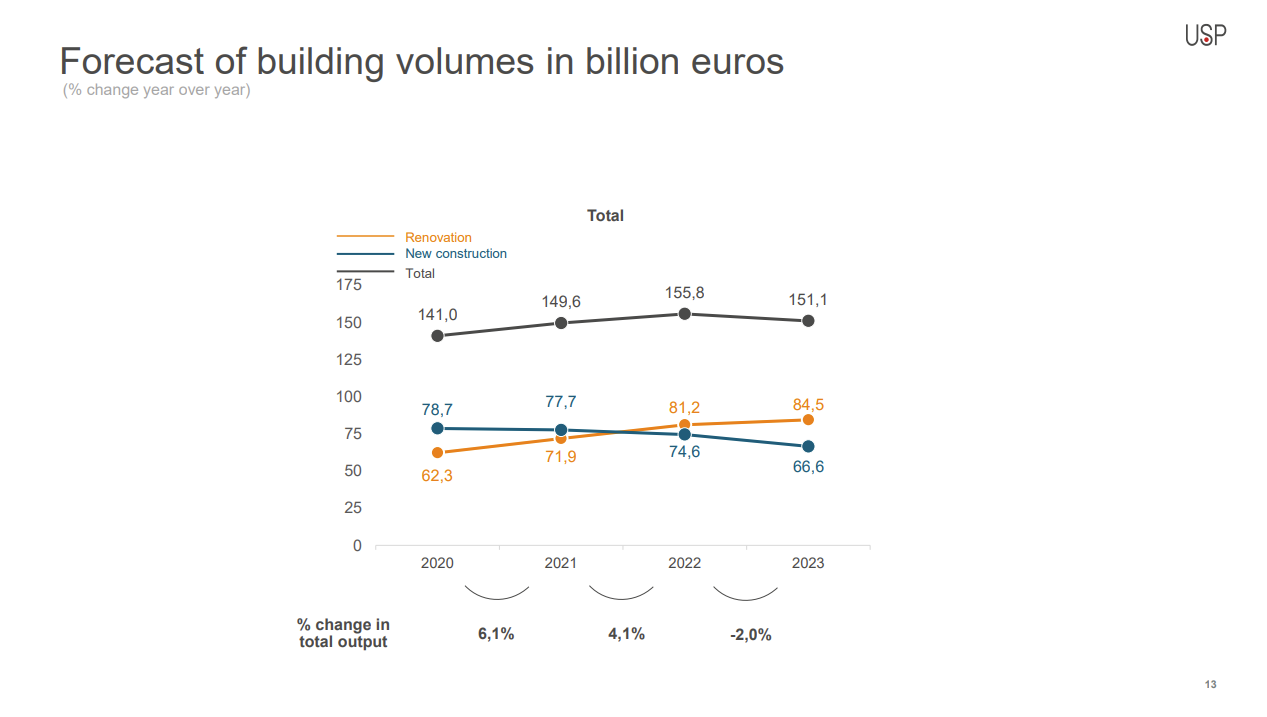

Architects play a pivotal role in the construction industry, serving as early indicators of both positive and negative changes. The trends and developments within architectural firms serve as valuable predictors for the overall construction market. USP publishes forecasts for building volumes based on insights gained from the experiences of architects (but also all other stakeholders that are regularly interviewed by USP in the construction business value chain) and 11 other market indicators. Our future building volumes predictions have proven accurate and have stood the test of time.

Key questions answered

Which brands, by category, are the most recognized and used among European architects?

Which manufacturer leads in the construction industry among architects?

What is the percentage of canceled projects, and what is the expected turnover in Q4 2022 by country?

The construction forecast outlook for 2022 and 2023.

Table of content

- Forecast overview

- Economic and construction figures

- United Kingdom

- Germany

- France

- Spain

- Italy

- Netherlands

- Belgium

- Poland

- Love brands

- Leading manufacturers in the construction industry

- Floor and wall tiles

- Insulation materials

- Floor covering products

- Facade cladding

- Bathroom products

- Daylight solutions

- Lighting systems and solutions

- Sun cladding

- Waterproofing solutions

- Paint

- Ventilation and indoor climate solutions

- Ceiling tiles

- Masonry products

- Smart home systems

- Research background

Frequently asked questions

-

Which manufacturer brands are the leaders in construction, according to architects?

Architects do not unanimously agree on a leader in construction, but the manufacturer that garners the most recognition is Knauf insulation (12%), followed by Saint-Gobain (9%) and Wienerberger (9%).

-

Which is the leading brand among architects for floor and wall tiles in Europe?

Porcelanosa is the first brand that comes to mind for floor and wall tiles, with a spontaneous awareness score of 16%. However, when it comes to actual usage, it drops to 7%. Marazzi is the most used brand, with a 7% usage rate, and it also scores 17% in brand awareness.

-

Which is the leading brand among architects in bathroom products in Europe?

Grohe is the most recognizable brand among architects, with a spontaneous awareness rate of 25%, and it holds the top position in terms of usage, with 11%.

-

Which is the most recognizable brand among architects for daylight solutions?

VELUX is by far the most spontaneously mentioned brand (52%) for daylight solutions, with a usage rate of 35%.

-

Which is the most recognizable brand among architects for lighting solutions?

Philips Lighting is the most recognizable lighting solution among architects, scoring 12% in recognition. However, when it comes to usage, it drops to 4%. The most used lighting solution is iGuzzini (9%), with a spontaneous awareness score of 11%.

Contact us

Send us a message

Please contact our office or fill in the contact form and our specialists will contact you.

PHONE

+31 10 2066900ADDRESS

Max Euwelaan 51

3062 MA Rotterdam