year

2022

No. of pages

45

Target group

General construction companies/builders with more the 5 employees

Key research topics

The digitalisation & BIM usage and adaptation among contractors

Methodology

Based on 950 successful quantitative telephone interviews in native languages

Country scope

Spain, Italy, France, Belgium, the Netherlands, the UK, Germany and Poland

Deliverables

Full report in pdf or ppt covering all 8 countries, support from a key account manager in case of questions

Publication frequency

Bi-annual

Price

6,000 Euro

What is this report?

This report provides a comprehensive view of the state of digitalization and BIM adaptation in the construction industry, specifically among European general contractors. In the report, you will find the current status of BIM adoption, the prognosis for future adoption, barriers and drivers, and many more insights. This information can help you shape, sharpen, or develop your digital strategy & BIM for general contractors. This research is based on quantitative telephone interviews with 950 registered general contractors (with 5 or more employees) distributed across the 8 major European markets.

Why do you need this report?

This report will provide key insights into digitalization and BIM adaptation among general contractors. These insights will be particularly valuable for manufacturers, software suppliers, and wholesalers targeting this group, as the insights in the report can validate the current BIM/digitalization strategy or lay the foundations for new strategies to come. Furthermore, understanding general builders’ behaviour and their adoption of BIM and digitalization will facilitate fact-based internal discussions without the need for custom research.

How was the research conducted?

This report is based on 950 successful quantitative telephone interviews with general contractors, conducted in the native language in Spain, Italy, France, Belgium, the Netherlands, the UK, Germany and Poland. The report is based on a representative sample of contractors, with companies with less than 5 employees being excluded. This research is conducted biannually, with reports covering different key marketing topics like media orientation, BIM, prefab, sustainability, and many more.

What is included in this report?

The primary focus of this research is to provide key insights into digitalization and BIM usage among general contractors, with a specific focus on the adaptation of these models and the speed of adaptation. The study also offers insights into contractors’ attitudes toward digitalization and whether they perceive it as beneficial in terms of efficiency. It highlights key differences among the 8 European countries covered and provides other key insights.

The report also includes a detailed view of the turnover and orderbook developments of the general contractors and background information on their company size, activities, segments most active, and other relevant information. This report will be a crucial input for shaping, improving, or reviewing your current BIM and digitalization strategy.

Key questions answered

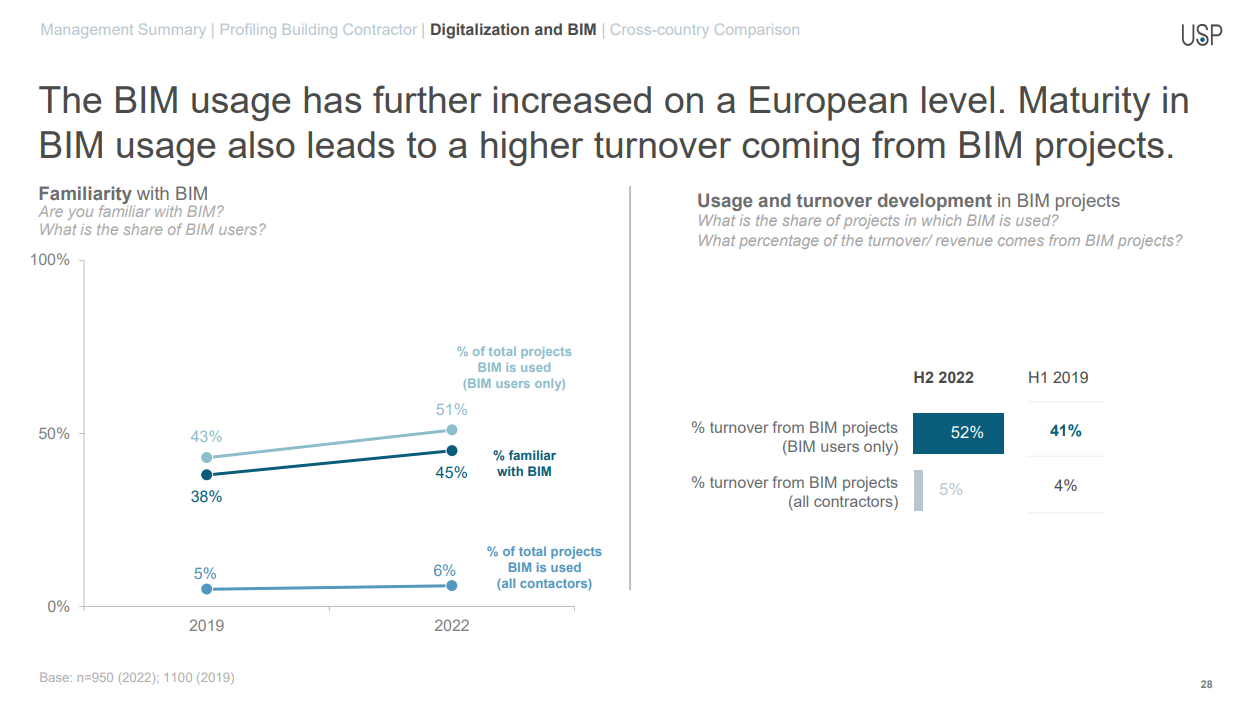

- How familiar are contractors with BIM, and what is the user share?

Which digital tools are most frequently used? - How do contractors perceive the effectiveness of BIM?

What are the primary advantages and limitations of BIM? - What are the main reasons for not using BIM?

- Which BIM features are used most frequently?

Table of content

- Management Summary

- Business developments

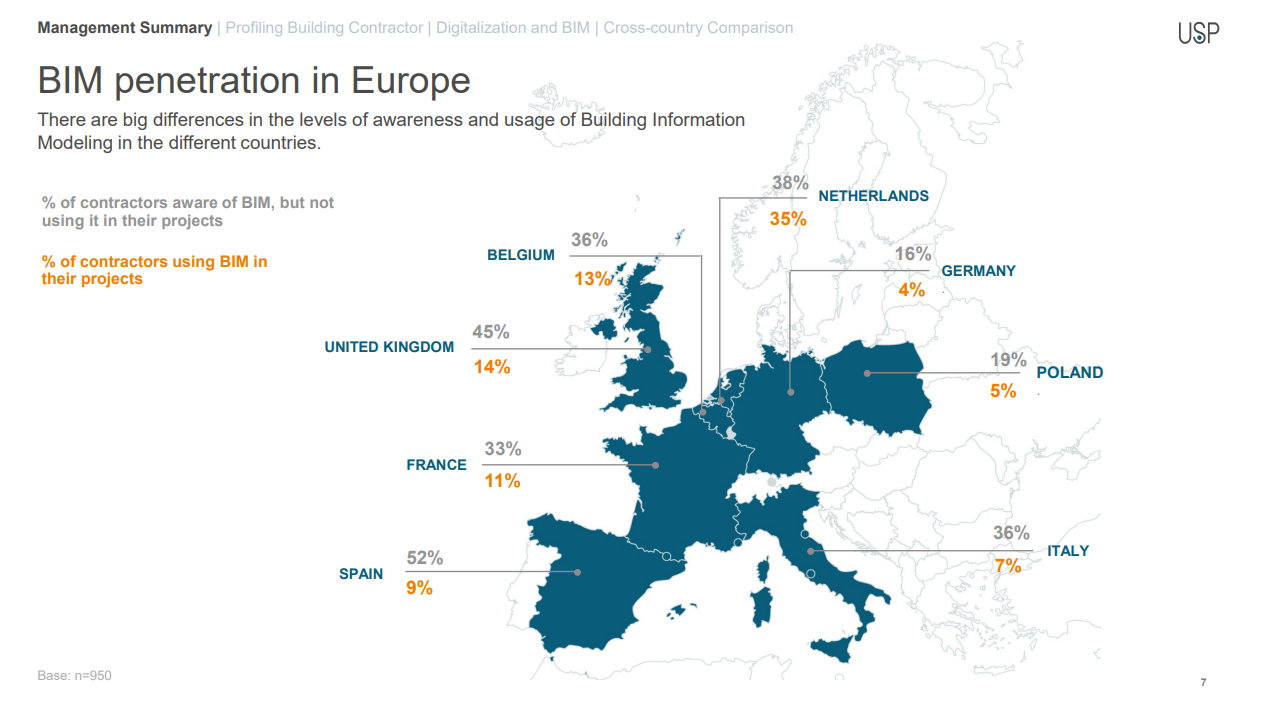

- BIM penetration in Europe

- Profiling the building contractor

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Belgium

- Poland

- Digitalisation and BIM

- BIM adaptation among general builders

- Cross-country comparison

Frequently asked questions

-

Will BIM and digitalisation lead to a more efficient construction process according to European contractors?

About 62% of European contractors believe that digitalization can make construction more effective.

-

Which online shop do UK contractors use the most?

Amazon is the most commonly used online shop in the UK. The primary reason contractors buy from pure online shops is the delivery, with 51% of contractors stating this as the main reason.

-

What are the key reasons for contracting companies to start using BIM according to contractors?

The main reason for using BIM is the need to optimize business processes; 27% of general builders stated that. The second reason is that they are influenced by the market or other parties; 20% of contractors confirmed that statement.

-

Which digital tools are most frequently used among general contractors?

E-commerce and e-procurement are the most commonly used digital tools among European contractors.

-

Where do European contractors most commonly purchase their products, including insulation materials, adhesives and sealants, roof windows and daylight solutions, waterproofing solutions, power tools, and masonry/bricks?

The leaders in the use of BIM are the contractors in the Netherlands, with 35% of them using BIM in their projects.

-

What are the main drivers for contractors buying from wholesalers?

When purchasing from wholesalers, relationship or trust is as strong a driver as price.

-

Where do contractors search for information on BIM?

Generally, the internet (Google/search engines) and manufacturer websites or libraries are the most commonly used channels for contractors to obtain information on BIM.

Contact us

Send us a message

Please contact our office or fill in the contact form and our specialists will contact you.

PHONE

+31 10 2066900ADDRESS

Max Euwelaan 51

3062 MA Rotterdam