year

2024

No. of pages

81

Target group

Building contractors who are active in residential and non-residential segments, companies with more the 5 employees

Key research topics

Prefab usage amongst European contractors

Methodology

Based on 940 successful quantitative telephone interviews in native languages

Country scope

Spain, Italy, France, Belgium, the Netherlands, the UK, Germany and Poland

Deliverables

Full report in pdf or ppt covering all 8 countries, support from a key account manager in case of questions

Publication frequency

Bi-annual

Price

6,000 Euro

What is this report?

In this report, we provide a comprehensive view of the state of prefab usage in the construction industry, with a specific focus on European general contractors. The report includes information about the current status of prefab adoption, forecasts for future adoption, the types of prefab elements most commonly used, the types of projects in which they are employed, and many other valuable insights. This information can assist you in shaping, refining, or developing your prefabrication business strategy targeting general contractors. The research is based on quantitative telephone interviews with 940 registered general contractors (with 5 or more employees) distributed across the eight major European markets. To preview a sample of this report, click here

Where can I see how this report looks like?

To make your purchase decision easier, we’ve prepared a sample of the report for you — to preview it, click here.

Additionally, you can contact us for a free demonstration where we will answer all your questions and help you select the most suitable report for your business. To contact us, click here.

Why do you need this report?

This report will provide key insights into the usage of prefab among general contractors. These insights will be particularly valuable for manufacturers and wholesalers targeting this group, as the information in the report can either validate their current business strategies revolving around prefabrication or lay the foundations for new ones. Furthermore, understanding general builders’ behavior and their attitudes toward the usage of prefab in construction will facilitate fact-based internal discussions without the need for custom research.

How was the research conducted?

This report is based on 940 successful quantitative telephone interviews with general contractors, conducted in native language in Spain, Italy, France, Belgium, the Netherlands, the UK, Germany and Poland. The report is based on a representative sample of contractors, with companies with less than 5 employees being excluded. This research is conducted biannually with the reports covering different key marketing topics like media orientation, BIM, prefab, sustainability and many more.

What is included in this report?

The primary focus of this research is to provide key insights into prefab usage among general contractors, with a specific focus on the types of prefab elements that are used, in which type of projects are they used and the future expectations. The study also offers insights into contractors’ attitudes toward prefab and whether they perceive it beneficial in terms of efficiency in construction. It highlights key differences among the 8 European countries covered and provides other key insights. The report also includes a detailed view on the turnover and orderbook developments of the general contractors and background information on their company size, activities, segments most active in and other relevant information. This report will be a crucial input for shaping, improving or reviewing your business strategy towards prefabrication.

Key questions answered

Who holds the most influence when deciding to use prefab elements?

How do contractors perceive the use of prefab elements, as a positive or negative aspect in construction?

How has the use of prefab elements been evolving over time?

To what extent does the usage of prefab depend on the size of the project?

In which types of houses are prefab elements predominantly used?

Which prefab elements are commonly used?

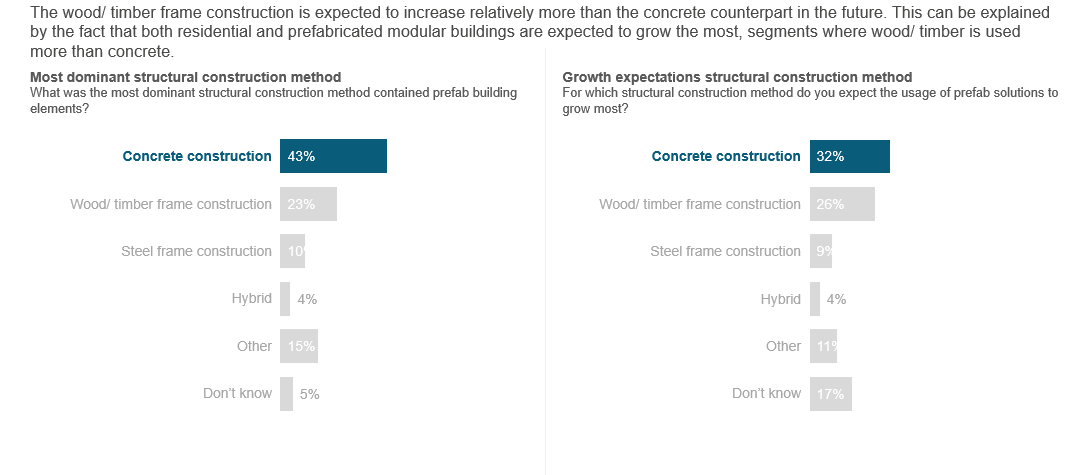

What are the most commonly used materials in prefab construction?

Table of content

-

- Preface

- Management summary

- Profiling the building contractor

- Theme part: Prefab

- Appendix

Frequently asked questions

-

Which challenges do the use of prefab elements address in the construction industry, according to European contractors?

Despite all the advantages in usage of prefab, it also brings along some challenges such as higher initial investments, higher transportation costs and a longer lead time.

-

What are the most prominent advantages of using prefab according to European contractors?

Saving time is the top reason for using prefab, with 68% of European contractors citing it as their primary motivation. saving money (10%) and increased cost-efficiency (6%) are on the 3rd and 4th place in ranking the advantages of prefab in construction.

-

What is the growth in the usage of prefab among European contractors?

In Europe, prefab usage has decreased by 17% in the last four years. The Netherlands still has the highest share of usage.

-

In which country is prefab most often applied?

The Netherlands has the highest share of usage with 42%

-

Who makes the final decision wheter or not to use prefab?

Among European contractors, 34% of them say that contractors are the ones who makes the final decision, then 29% say that building owners/end clients are the ones and 25% say that architects are the ones.

Contact us

Send us a message

Please contact our office or fill in the contact form and our specialists will contact you.

PHONE

+31 10 2066900ADDRESS

Max Euwelaan 51

3062 MA Rotterdam