Market report

Key Trends in European Construction

The European Architectural Barometer tracks the latest developments in the construction industry, from sustainability to digitalization and workforce challenges.

Blogs I published 29 March 2024 I Dirk Hoogenboom

Top Five Construction Industry Trends in 2025

The European construction industry remains one of the more traditional industries in Europe, yet this doesn’t mean that it is not effected by key developments and trends. In this article, we aim to spotlight five key trends in the construction industry.

Trend 1: Labour shortage in Construction industry

One of the biggest trends, or threat, to the European construction industry are the labour shortage problems. This issue is pervasive not only in Europe but also across numerous global regions. Within Europe, various industries grapple with labour shortages, with the construction sector experiencing particularly acute challenges.

The average age of construction workers in Europe is notably high, hovering around or even exceeding 50 years in many cases. This demographic reality forecasts a significant outflow of highly skilled personnel in the years ahead. Making things worse is the fact that there is a lack of an influx of younger workers into the construction industry. The construction sector struggles to compete with other industries in attracting younger generations, as construction jobs are often seen as inferior both in terms of pay and in terms of the work itself. It’s seen has hard, dirty and potentially dangerous work.

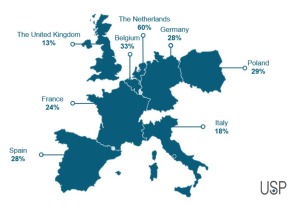

How bad is the labour shortages in the European construction industry currently? Well, in our various multi-client studies, we asked key stakeholders in the business value chain to what degree they are hindered by labour shortages. In some countries, like in the Netherlands, almost 70% of all of the architects and contractors state that they are severely hindered by labour shortages. But this is not just a problem in the Netherlands, for example in Germany almost three quarters of installers and almost 90% of painters state that they face severe labour shortages issues. The biggest issues are in Northern and central European countries. The problems also exists in more southern European countries, but are in general less severe.

Now this only covers the quantitative labour shortage issues. Beyond mere quantitative concerns, a qualitative labour shortage looms. The impending retirement of experienced workers, rich in both years of service and depth of knowledge and the inflow of less experienced and practically schooled workers, poses significant challenges as buildings and installations become more complex and require more knowledge and skill rather than less.

One of the key ways many stakeholders think they can combat labour shortage short term is to hire non-qualified staff and train them. However, many other industries that face labour shortages employ a similar strategy. Furthermore, the time needed to train non-qualified staff and get them productive is rather high, further increasing the labour shortage issues short term. Are there no other solutions for the labour shortage problems? Yes, there are and we will focus one of them for the next trends.

Image 1: Are you being hindered by labour shortage?

Trend 2: Prefabrication in Construction industry

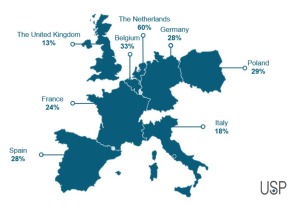

Prefabrication emerges as a vital strategy to address labour shortages. The construction industry increasingly turns to prefabrication as a means of enhancing efficiency and productivity. For example, according to Dutch contractors, the share of projects containing some form of prefab is already high at approximately 70%. In other European countries this share is lower, but still relatively high. For example in Germany, Belgium, Poland and Italy, the share of prefab in projects is about 50%. On a total European level this is approximately 41%.

Furthermore, the expectations for the future are high. Even though short term both architects and contractors foresee a slowdown of the growth of prefab in construction due to lower new build volumes, mid-term contractors foresee the share of prefab growing strongly.

While prefabrication has witnessed steady growth in recent years, its potential remains largely untapped. The current emphasis primarily centres on basic prefabricated elements such as walls and floors.

To fully leverage the benefits of prefabrication and to increase the overall productivity levels in the construction industry , a shift towards more industrialized processes is imperative. This entails greater utilization of advanced prefabricated panels and volumetric solutions produced in an industrialized manner. Most of the ‘simpler’ forms of prefab basically entails offsite construction in an onsite manner, which will not bring the big jumps in productivity levels that are needs. For this, more advanced forms of industrialised prefab production are needed.

While progress in this direction is evident, the adoption of advanced forms of prefabrication like prefabricated modular buildings remains relatively limited. According to European architects, these types of prefab only accounts to 12% of the total prefab being applied. The more simple prefabricated plain and unfinished elements account for 50% of all prefab being applied. That being said, both architects, contractors and installers alike, foresee a strong growth for more advanced forms of prefab in the future.

In order for more advance forms of industrialised prefab to grow significantly, the industry needs to overcoming existing barriers, including technological constraints and regulatory compliance. Furthermore, in order to facilitate more advanced forms of prefab, more digitalisation is needed.

Image 2: Share of prefab in projects – architects

Trend 3: Digitalisation in Construction industry

As observed, labour shortage is a key problem in the construction industry and prefabrication is one of the key solutions. However, in order to build utilising more advanced forms of prefab more digitalisation is needed.

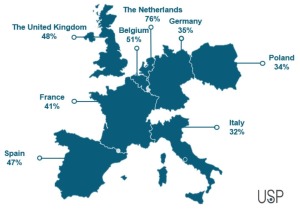

Building Information Modelling (BIM) stands as a prime example of digital innovation reshaping construction practices. While BIM adoption varies across European countries, its prevalence among architects is notably high. Approximately 45% of all European architects are BIM users. This number is very country depended tough, as more than three quarters of Dutch architects are BIM users, compared to for example only 32% of Italian architects. Furthermore, this percentage shifts up or downwards depending on the company size (the bigger the company, the more likely it is they use BIM).

However, even though BIM usage is relatively high amongst European architects, the usage of the more advance features (4D and 5D) remains limited. Furthermore, the level of detail (LOD) which is most commonly specified is LOD 300.

Furthermore, BIM adoption amongst stakeholders deeper in the construction business value chain remains limited. For example, ‘only’ 35% of contractors in the Netherlands are BIM users, compared to the 75% of architects. In many other European countries the BIM adoption amongst contractors is lower still, for example in the UK only 14% of the contractors are BIM users. Again, we need to bear in mind that company size plays a significant role. For installers, the BIM usage is even lower, with approximately 8% being BIM users.

Nevertheless, the trajectory towards increased digitalization is expected to persist, fuelled by legislative mandates and the growing prominence of prefabrication. As construction projects become increasingly complex, digital tools like BIM play a pivotal role in streamlining processes and facilitating the integration of prefabricated elements.

Image 3: What is the share of BIM users in Europe?

Trend 4: Sustainability in Construction industry

Sustainability has taken centre stage in the discussion about the future of the construction industry. As this industry is responsible for a high amount of the Co2 output (both in the production materials and construction process itself, but especially in the operation of the buildings).

Amid mounting concerns over climate change and resource depletion, sustainability has gotten heightened attention within the construction sector. Efforts to reduce carbon emissions and enhance energy efficiency are at the forefront of sustainability initiatives. Legislative measures aimed at promoting sustainable building practices further underscore this shift. However, despite growing awareness and regulatory impetus, the pace of sustainable adoption remains gradual. Intrinsic motivations among key stakeholders often lag behind regulatory mandates, hindering widespread adoption. Also, the high costs of more sustainability remains a barrier.

For example, the widespread adoption of heat pumps in the European market by the early adopters following the energy crisis, has not been followed by a widespread adoption of the early majority. The high costs, partly due to the high product & installation cost, remains a barrier. Furthermore, not all houses and buildings are suited for a swift transition. However, it’s important to understand that the market is still growing, but perhaps not at the high speed that was initially anticipated.

Furthermore, the ‘jungle’ in terms of different regional, national and European legislation also slows down the speed of adoption. Green washing by various stakeholders in the industry is also not helping the market becoming more transparent.

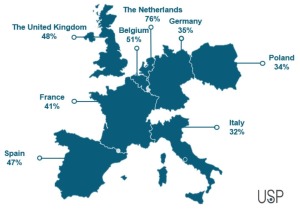

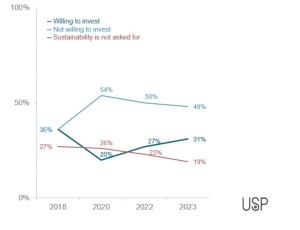

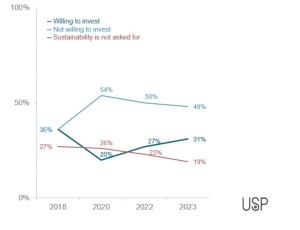

That being said, the willingness of clients to invest in sustainability, according to architects, have decreased from 34% in 2020, to 28% in 2022 and 27% in 2024. And it’s undeniable that the European construction industry is increasing its sustainable transformation and that this movement will have a strong impact on the construction industry. However, it has proven to be more of an increase in the evolution instead of a revolution.

Image 4: To what extent do your clients ask for sustainability and are they willing to invest more in it? – architects

Trend 5: Changes in the decision making process within Construction industry

Lastly, a transformation in the decision-making process within the construction industry is underway. Historically, architects assumed the role of master builders, wielding authority over all project facets. However, evolving dynamics, including heightened building complexity and expanded stakeholder influence, redefine the architect’s role. Architects increasingly pivot towards project management, prioritizing aesthetic design and material selection over brand preferences.

This shift reflects broader industry trends towards collaborative decision-making and greater stakeholder involvement. ‘New’ players, such as major prefab producers and innovative construction firms employing design-build practices further erode the central role of the architects. Furthermore, the ‘end users’ or the principles assign the projects are more involved in the design and building process.

The increased complexity of the decision making process and the amount of actors sitting at the table earlier, also requires better cooperation. Again, BIM is an important tool to facilitate this.

Image 5: Can you indicate what your role is in the following parts of the process?

Conclusions

One way of summarising the key trends in the construction industry for 2024 and beyond is that the construction industry needs to become better, faster and cheaper. Most of the trends we discussed can be tied towards making the industry better (i.e sustainability, increased stakeholder collaboration, digitalisation etc), faster (i.e prefab, labour shortage etc) and cheaper (i.e labour shortage, digitalisation, prefab etc).

All of the 5 key trends are shaping the industry now and in the future. However, many of the developments should be seen as evolutionary and not revolutionary. Yes, in some cases the speed of adoption will increase, but the conservative nature of the industry, technological limitations, legislation and other external factors are still hindering a true ‘revolution’.

And as a final note, we deliberately did not list trends like robotics, 3D printing and AI/Iot on the list of the 5 key trends in construction for 2025 as even though they are interesting and potentially very impactful, these trends could be categorised under trends like prefab (3D printing), Labour shortage (robotics) and digitalisation (AI/IoT). Furthermore, these trends are expected to have an impact mid-to-long term, instead of short term.

Construction Consulting Services for You

We provide tailor-made market research and off-the-shelf reports, both B2B & B2C, qualitative and quantitative. Here are some you might be interested in

Uncover opportunities and new trends shaping the construction landscape for 2024 and beyond.

Understand the overall construction market scope to plan resource allocation effectively.

Identify the key factors propelling innovation and investment in construction for the coming year.

Read more

Fresh Insights Await

Our relevant reports

Delve into the newest findings across various market segments, crafted for a cutting-edge overview. Explore our insightful reports, brimming with up-to-date data, trend analyses, and in-depth examinations, all tailored to provide you with a comprehensive understanding of the current market dynamics.

Construction

Home Improvement

Installation

Special reports