Market report

Consumer's behaviour among handymen

Browse through the latest market reports on contractors at USP Research's Handymen Insights Monitor. Stay updated with valuable insights and trends in the industry.

News I published 21 April 2022 I Dirk Hoogenboom

Targeting professional handymen through consumer channels

Professional brands of construction and installation products and materials may be reluctant to place their brand in purchase channels for consumers, and for good reason. After all the effort to create the image of a professional brand, that image may be damaged when your products are found next to brands for general consumers in a DIY or hardware store. However, those professional brands may be missing out on selling to the numerous European professional handymen that use consumer purchase channels.

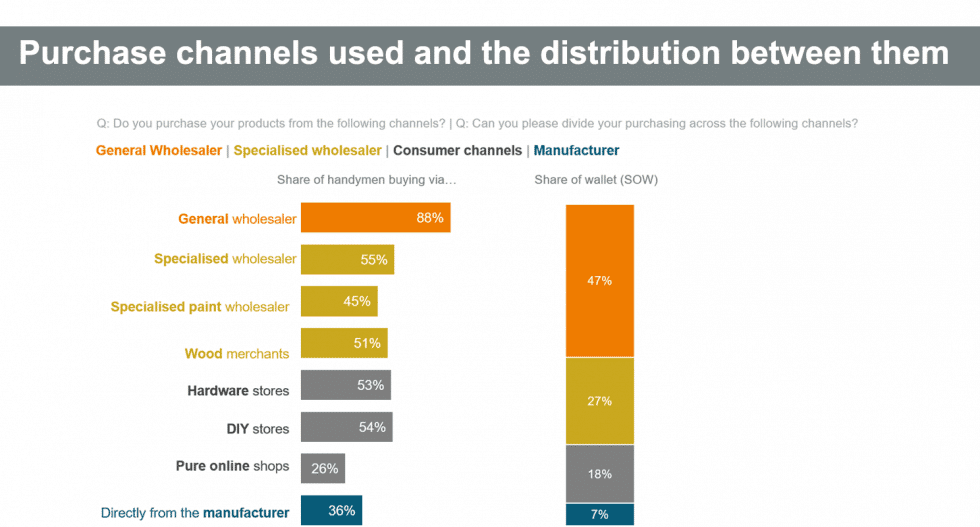

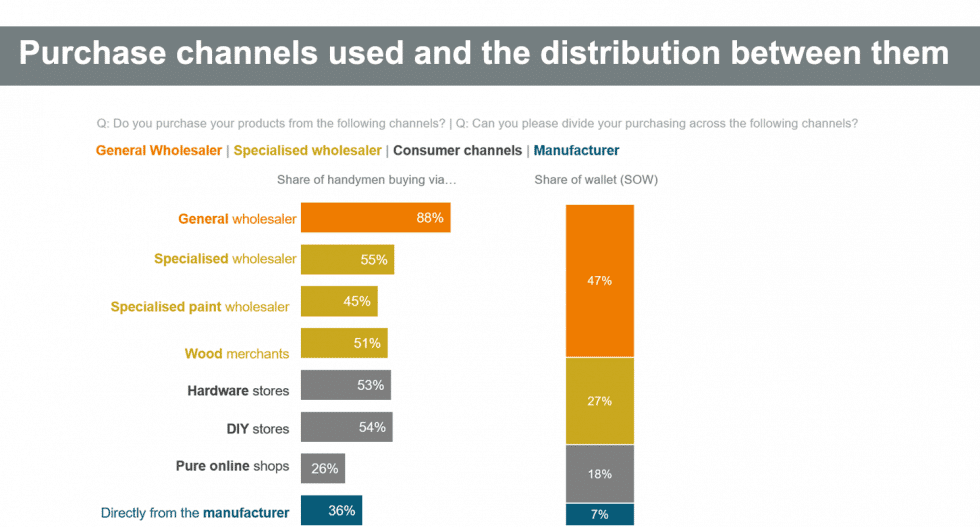

European professional handymen are not just remarkably diverse due to the different types of jobs they do, they also use a diverse array of purchase channels to acquire the necessary materials and products. As we found in the research for USP Marketing Consultancy’s 2021 European Handyman Monitor, handymen may spend half of their budget at general building material wholesalers, but the rest of their budget is spent at various purchase channels, including consumer channels.

One fifth of handymen’s budget is spent at consumer channels

More than half of European handymen report to use Hardware stores and DIY stores to purchase products needed for their projects. Pure online shops are used by just over a quarter of European handymen. These shares differ significantly per country though. DIY stores are reportedly used by a whopping 70% of handymen in Germany and the UK, but only by 40% in the Netherlands, for instance. Similar differences can be seen in Hardware store and pure online shop usage.

When looking at the share of budget spent at these individual channels, significant differences can be seen per country as well. 9% of the total budget of European handymen is spent at European DIY stores. In Germany, with the largest share of handymen reporting to use DIY stores, the share of budget spent there is 16%. In the Netherlands, Handymen only spend 4% at DIY stores, but they spend a whopping 12% of their budget at hardware stores.

What differs less per country is the share of budget spent at DIY stores, hardware stores and pure online shops combined. European handymen spend close to one fifth of their budget at these consumer channels. Looking at individual countries, this share ranges from 14% in Spain, to 22% in Germany and Poland.

Consumer channels could be quite lucrative for professional brands

Given the vast number of handymen in Europe, around one fifth of their budget spent at consumer channels is a serious amount of money. Even though there is good reason for a professional brand to avoid consumer channels to uphold its professional image, the above might make them reconsider. If you produce products that are often used by handymen and your professional brand is available in for instance DIY stores, chances are high the handymen shopping there will find and buy them.

The DIY stores are an especially valid example here because they have another characteristic that is important for the multi-skilled handymen. Given the variety of products they use, purchasing those products takes time. Finding many different product groups in one place saves time, and 55% of European handymen state that one-stop shopping is becoming more important. General wholesalers might have that characteristic, but the DIY store around the corner can also be a one-stop shop for many items handymen need.

To find out which products handymen use the most and where they shop for those products in seven major European markets, we refer you to the 2021 report of USP Marketing Consultancy’s European Handyman Monitor.