Market report

Sustainability in installation industry

Discover the latest market trends and insights in the European electrical installation monitoring industry with USP Research's detailed market report. Explore key data and analysis to stay informed.

News I published 06 June 2024 I Maja Markovic

Sustainability in the electrical installation sector; slow but steady growth

The construction and installation sectors are closely intertwined with sustainability topics. Over the past decade, numerous initiatives have aimed to foster industry support for sustainable development agendas. Installation systems play a vital role in creating sustainable buildings and reducing CO2 emissions.

In recent years, the HVAC side of the installation segment has received most attention, at least in the media and due to the gas and oil crisis following the war in Ukraine. But what about the electrical side of the installation segment? This is the core topic of our latest Q1 2024 report of the European electrical installation monitor on sustainability.

Slower but more sustained growth

In the last years, the electrical installation market has seen an uptick in the share of projects where sustainability played a role. However, generally speaking it can be categorised as a steady and sustained growth (not in all countries, more on that later). Especially in comparison with the boom of sustainable solutions in the HVAC market or recent years (for example the explosive heat pump growth).

But whereas we see a sudden slump in heat pump sales, and even in projects that involve sustainable solutions in the HVAC sector, the electrical installers report that the steady growth of recent years will continue.

Country differences

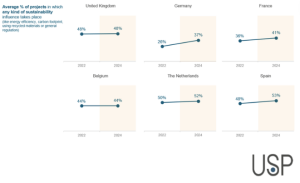

When looking at the share of projects in which sustainability place a role and compare this with the previous measurements in 2022, a moderate increase is reported by the electricians in the Netherlands, Spain and France in 2024.

German installers report a very high increase in the share of projects where sustainability place a role. However, it’s worth noting that the share of projects where sustainability plays a role was the lowest in Germany in 2022 and still is, despite the strong growth, in 2024.

In Belgium and the UK there was no to minimal growth reported between 2022 and 2024.

LED lighting and PV are in the highest demand

One of the key reasons for slow down of sustainability improvements in the HVAC sector have to do with, besides a drop in the sense of urgency, the high costs. Both material and labour cost increased significantly and the interest rates remain on a relatively high level. This means the willingness to invest is lower. Also we need to consider that the majority of the growth came from early adopters and now the early majority needs to buy in, who typically have less financial means or less suited houses/buildings.

It’s no surprise then that in the Electrical installation sector, where these considerations also play a role, a low cost sustainably solutions takes the spot for most used sustainable solution/product. We are talking here about LED lighting. A strong number two are PV panels. Other solutions, ranging from battery storage to EV and energy management solutions score significantly lower. Again, we need to consider that there are clear differences between the countries, not so much for the top 2, but for the solutions that come after that.

Knowledge of material passports and EPD still low

The familiarity of installers with terms like material passport and Environmental Product Declarations remains low, suggesting these concepts have minimal influence on their decision-making processes.

The highest familiarity with EPD’s can be found in the UK, but still only 28% was familiar with the term. Of that 28%, 40% takes EPD’s into consideration in the selection of products.

The highest familiarity with material passports can be found in the Netherlands, where approximate 30% is familiar with the term.

More insights

These are just some insights from the Q1 2024 European Electrical Installation monitor on sustainability. This report, based on quantitative telephone interviews with electrical installers in 6 countries, covers much more. For example, the report covers (on a country level), the perception of sustainability, the willingness to pay (end customers and business customers), perception and most used installation products and much more. The full report is now available for 3,150 Euro.

In case of any questions, feel free to contact us.

Installation Consulting Services for You

We provide tailor-made market research and off-the-shelf reports, both B2B & B2C, qualitative and quantitative. Here are some you might be interested in

Monitor and improve client relationships to drive loyalty and repeat business in construction.

Map out key interactions and pain points to refine the overall construction experience.

Identify the aspects of service or product that most impact satisfaction in construction projects.

Read more

31 July 2024 I Dirk Hoogenboom

How is the smart and connected products market evolving in Europe?

02 July 2024 I Dirk Hoogenboom

BIM adoption among European HVAC installers remains low

10 May 2024 I Dirk Hoogenboom

Sustainability in the electrical installation industry

26 March 2024 I Ralitsa Ruseva

What are the best topics for training according to HVAC installers in Europe?

Fresh Insights Await

Our relevant reports

Delve into the newest findings across various market segments, crafted for a cutting-edge overview. Explore our insightful reports, brimming with up-to-date data, trend analyses, and in-depth examinations, all tailored to provide you with a comprehensive understanding of the current market dynamics.

Construction

Home Improvement

Installation

Special reports

Construction

Smart Materials and Buildings Q4 2024

2024 85 pages

Explore the evolving future in construction sector among European architects in Q4 2024. Delve into the factors driving material preferences and the impact on construction aesthetics and sustainability.

2,000 Euro

Construction

Digitalisation and BIM H2 2024

2025 64 pages

Uncover the preferred purchase channels of contractors in H2 2024, and understand how purchasing behaviors evolved. This report provides insights into the factors influencing purchasing decisions among contractors.

6,000 Euro

Construction

Decision making process Q3 2024

2024 87 pages

Unveil the decision-making processes in the construction industry through the lens of European architects. Discover the factors that influence crucial decisions and the interplay among different stakeholders.

2,000 Euro

Construction

Prefab H1 2024

2024 63 pages

Discover the adoption rate and benefits of prefabrication technology among European contractors in H1 2024. Understand the driving forces behind prefab usage and its impact on project efficiency and cost-saving.

6,000 Euro

Construction

Future of construction Q2 2024

2024 82 pages

Explore the evolving future in construction sector among European architects in Q2 2024. Delve into the factors driving material preferences and the impact on construction aesthetics and sustainability.

2,000 Euro

Construction

Sustainability 2024

2024 72 pages

Painter Insight Monitor 2024 will focus on understanding the specific needs, preferences, and challenges faced by painters when it comes to sustainable products.

11,000 Euro

Home Improvement

DIY vs DIFM Q4 2024

2025 76 pages

Explore the prevailing trends between DIY and DIFM in Q4 2024. Understand consumer preferences and the factors influencing their choice between DIY and DIFM.

3,500 Euros

Home Improvement

Branding Q3 2024

2024 74 pages

Discover the power of branding in the home improvement sector. Explore how strong branding influences consumer preferences and purchase decisions.

3,500 Euro

Home Improvement

European Garden Monitor

2023 43 pages

Explore the European Garden Monitor, a comprehensive platform dedicated to garden health monitoring in Europe. Access valuable resources and expert advice today.

12,000 Euro

Home Improvement

Purchase channels Q2 2024

2024 90 pages

The European Home Improvement Monitor offers valuable insights on purchase channels in the European home improvement industry, examining the evolving preferences and behaviors of consumers across traditional retail and emerging online platforms.

3,500 Euro

Home Improvement

Sustainability Q1 2024

2024 81 pages

Delve into sustainability trends in the home improvement sector in Q1 2024. Discover consumer preferences and the shift towards eco-friendly home improvement solutions.

3,500 Euro

Home Improvement

DIY versus DIFM Q4 2021

2024 113 pages

This report is a must-have if you’re in the home improvement industry. It provides a wealth of information on the behaviour of DIY and DIFM consumers, their motivations, and the factors that influence their purchasing decisions.

3,150 Euro

Installation

Training needs Q1 2025

2025 100 pages

This report offers an overview of installers’ habits and preferences concerning their education. Furthermore, the report encompasses the pervasive challenge of workforce shortage and explores the sector’s strategies for resolving this issue.

3,250 Euro

Installation

Media orientation Q4 2024

2025 128 pages

The European Mechanical Installation Monitor report provides a detailed analysis of the plumbing and HVAC industry. This report specifically focuses on Media Orientation in the industry.

2,800 Euro

Installation

Services in the installation sector Q4 2024

2025 102 pages

This report provides a comprehensive view of the installer's requirements for services from manufacturers. Within the report, you will find information on the most needed services in each category: commercial processes, engineering, products & installation, and repair & maintenance. It also examines the services that installers offer to their customers.

3,250 Euro

Installation

Prefab Q3 2024

2024 110 pages

Uncover the adoption of prefabricated products in HVAC installations during Q2 2022. Delve into the benefits and challenges associated with prefabrication in HVAC.

2,800 Euro

Installation

Prefab Q3 2024

2024 119 pages

This report offers a comprehensive view of the installers’ involvement and needs regarding prefabricated electrical installations.

3,250 Euro

Installation

Smart & Connected Products Q2 2024

2024 120 pages

This report provides a comprehensive view of the attitudes of installers toward smart building solutions, specifically among electrical installers and their clients. In the report, you will find insights into the installers' experiences with installing smart products and the willingness of end users to invest in such solutions, as well as their motivations and pain points.

3,250 Euro

Special reports

European Sustainability Report 2024

2025 51 pages

This report provides in-depth insights based on triangulation of key market information and data as well as data from USP Marketing Consultancy’s key monitors that are carried out year in, year out. The focus of this report is on the most important stakeholders within the construction industry, namely architects, contractors, electrical and HVAC installers within The United Kingdom, The Netherlands, Belgium, Germany, Poland, France, Italy, and Spain.

3,950 Euro

Special reports

European Sustainability Report 2024

2024 51 pages

This report provides in-depth insights based on triangulation of key market information and data as well as data from USP Marketing Consultancy’s key monitors that are carried out year in, year out. The focus of this report is on the most important stakeholders within the construction industry, namely architects, contractors, electrical and HVAC installers within The United Kingdom, The Netherlands, Belgium, Germany, Poland, France, Italy, and Spain.

3,950 Euro