Market report

smart and connected products in installation industry

Gain valuable insights into the European electrical installation monitor market with the comprehensive market report from USP Research. Stay informed and make data-driven decisions.

News I published 31 July 2024 I Dirk Hoogenboom

How is the smart and connected products market evolving in Europe?

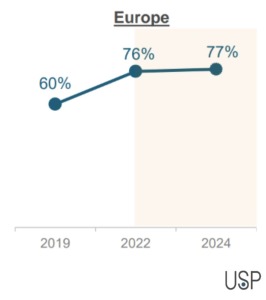

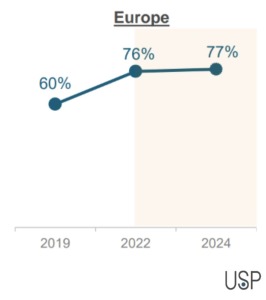

Every two years, USP marketing consultancy conducts a deep dive on smart and connected products in the European electrical installation monitor. In the lates version of this study, the Q2 2024 report on smart and connected products, more than 800 electrical installers in 7 key European countries voiced their opinion about the smart and connected products market.

Average % of companies involved in the installation of smart building products

Germany Leads the Growth, While the UK Faces Challenges

The market for smart products has shown remarkable stability across Europe, with Germany and Belgium leading the charge in growth. German electrical installation companies, in particular, have embraced smart technologies, reflecting a broader trend of digital transformation within the country.

However, the UK presents a contrasting scenario. Despite the overall steady market, the UK has experienced a decline in the adoption of smart products. This downturn is primarily attributed to the high failure rates associated with smart meters, including display issues, slow problem resolution, and compatibility problems with first-generation meters. These challenges underscore the importance of reliability and robust support mechanisms in fostering market growth.

Electrical and Lighting Industries at the Forefront

Smart products have found fertile ground in the electrical and lighting industries, with increasing demand driving innovation and adoption. Across most European countries, electrical installers view themselves as pioneers in the smart product domain. This perception is particularly strong in Germany and Belgium, where the integration of smart technologies is seen as a natural progression for the industry.

In contrast, France and Poland present a different picture. Here, home automation specialists are perceived as more adept at handling smart product installations. This highlights the varying dynamics within the European market, where expertise and industry leadership can differ significantly from one region to another.

The Complexity of Smart Product Installations

Despite the growing prevalence of smart products, many electricians find their installation more complex compared to traditional tasks. This complexity underscores the need for effective education and training. Manufacturers play a pivotal role in this regard, providing regular training sessions, comprehensive installation guides, and reliable technical support.

One electrician from Spain encapsulated the sentiment of many in the industry: “We need technical support to be immediate; we cannot wait for them to call us back because by the time they do, we are already off-site.” This highlights the critical need for real-time support to ensure seamless installations and minimize downtime.

Moving Forward: Strategies for Success

For manufacturers and industry stakeholders, addressing these challenges is crucial for sustained growth and market penetration.

Key strategies include:

- Enhanced Training Programs: Regular and comprehensive training sessions can equip installers with the necessary skills and knowledge to handle smart product installations efficiently.

- Detailed Installation Guides: Providing clear and detailed guides can simplify the installation process, reducing the perceived complexity.

- Robust Technical Support: Offering reliable and immediate technical support can significantly improve the installation experience, ensuring that issues are resolved promptly.

Conclusion

The smart and connected products market in Europe is poised for continued growth, driven by innovation in the electrical and lighting industries. However, regional disparities and installation complexities present challenges that need to be addressed. By focusing on education, support, and reliability, manufacturers and industry professionals can navigate these challenges, fostering a more robust and dynamic market for smart technologies.

Furthermore, a large part of the market is DIY focused. Solutions from companies like Amazon and Ikea centre around products that are easy to install by consumers themselves. This can be seen as both a positive and negative trend for the installers and manufacturers supplying them.

One the one hand, having more consumers exposed to the benefits of smart and connected products could lead to more interest in the more high end solutions typically installed by professionals.

On the other hand, a continued growth in the low end solutions market could also be a limiting factor for the professionals, as their involvement in this segment is minimal.

For the non-residential applications, the market outlook does look brighter, with an increased demand for solutions that can decrease energy consumption and can increase operating efficiency.

These are just some of they key findings of the report. The full report covers many more elements, like what products are installed, the evolution of the installation of smart and connected products overtime, the leaders in smart building solutions per county (manufacturers), future demands and remotely operated products.

Installation Consulting Services for You

We provide tailor-made market research and off-the-shelf reports, both B2B & B2C, qualitative and quantitative. Here are some you might be interested in

Monitor and improve client relationships to drive loyalty and repeat business in construction.

Map out key interactions and pain points to refine the overall construction experience.

Identify the aspects of service or product that most impact satisfaction in construction projects.

Read more

02 July 2024 I Dirk Hoogenboom

BIM adoption among European HVAC installers remains low

06 June 2024 I Maja Markovic

Sustainability in the electrical installation sector; slow but steady growth

10 May 2024 I Dirk Hoogenboom

Sustainability in the electrical installation industry

26 March 2024 I Ralitsa Ruseva

What are the best topics for training according to HVAC installers in Europe?

Fresh Insights Await

Our relevant reports

Delve into the newest findings across various market segments, crafted for a cutting-edge overview. Explore our insightful reports, brimming with up-to-date data, trend analyses, and in-depth examinations, all tailored to provide you with a comprehensive understanding of the current market dynamics.

Construction

Home Improvement

Installation

Special reports

Construction

Smart Materials and Buildings Q4 2024

2024 85 pages

Explore the evolving future in construction sector among European architects in Q4 2024. Delve into the factors driving material preferences and the impact on construction aesthetics and sustainability.

2,000 Euro

Construction

Digitalisation and BIM H2 2024

2025 64 pages

Uncover the preferred purchase channels of contractors in H2 2024, and understand how purchasing behaviors evolved. This report provides insights into the factors influencing purchasing decisions among contractors.

6,000 Euro

Construction

Decision making process Q3 2024

2024 87 pages

Unveil the decision-making processes in the construction industry through the lens of European architects. Discover the factors that influence crucial decisions and the interplay among different stakeholders.

2,000 Euro

Construction

Prefab H1 2024

2024 63 pages

Discover the adoption rate and benefits of prefabrication technology among European contractors in H1 2024. Understand the driving forces behind prefab usage and its impact on project efficiency and cost-saving.

6,000 Euro

Construction

Future of construction Q2 2024

2024 82 pages

Explore the evolving future in construction sector among European architects in Q2 2024. Delve into the factors driving material preferences and the impact on construction aesthetics and sustainability.

2,000 Euro

Construction

Sustainability 2024

2024 72 pages

Painter Insight Monitor 2024 will focus on understanding the specific needs, preferences, and challenges faced by painters when it comes to sustainable products.

11,000 Euro

Home Improvement

DIY vs DIFM Q4 2024

2025 76 pages

Explore the prevailing trends between DIY and DIFM in Q4 2024. Understand consumer preferences and the factors influencing their choice between DIY and DIFM.

3,500 Euros

Home Improvement

Branding Q3 2024

2024 74 pages

Discover the power of branding in the home improvement sector. Explore how strong branding influences consumer preferences and purchase decisions.

3,500 Euro

Home Improvement

European Garden Monitor

2023 43 pages

Explore the European Garden Monitor, a comprehensive platform dedicated to garden health monitoring in Europe. Access valuable resources and expert advice today.

12,000 Euro

Home Improvement

Purchase channels Q2 2024

2024 90 pages

The European Home Improvement Monitor offers valuable insights on purchase channels in the European home improvement industry, examining the evolving preferences and behaviors of consumers across traditional retail and emerging online platforms.

3,500 Euro

Home Improvement

Sustainability Q1 2024

2024 81 pages

Delve into sustainability trends in the home improvement sector in Q1 2024. Discover consumer preferences and the shift towards eco-friendly home improvement solutions.

3,500 Euro

Home Improvement

DIY versus DIFM Q4 2021

2024 113 pages

This report is a must-have if you’re in the home improvement industry. It provides a wealth of information on the behaviour of DIY and DIFM consumers, their motivations, and the factors that influence their purchasing decisions.

3,150 Euro

Installation

Training needs Q1 2025

2025 100 pages

This report offers an overview of installers’ habits and preferences concerning their education. Furthermore, the report encompasses the pervasive challenge of workforce shortage and explores the sector’s strategies for resolving this issue.

3,250 Euro

Installation

Media orientation Q4 2024

2025 128 pages

The European Mechanical Installation Monitor report provides a detailed analysis of the plumbing and HVAC industry. This report specifically focuses on Media Orientation in the industry.

2,800 Euro

Installation

Services in the installation sector Q4 2024

2025 102 pages

This report provides a comprehensive view of the installer's requirements for services from manufacturers. Within the report, you will find information on the most needed services in each category: commercial processes, engineering, products & installation, and repair & maintenance. It also examines the services that installers offer to their customers.

3,250 Euro

Installation

Prefab Q3 2024

2024 110 pages

Uncover the adoption of prefabricated products in HVAC installations during Q2 2022. Delve into the benefits and challenges associated with prefabrication in HVAC.

2,800 Euro

Installation

Prefab Q3 2024

2024 119 pages

This report offers a comprehensive view of the installers’ involvement and needs regarding prefabricated electrical installations.

3,250 Euro

Installation

Smart & Connected Products Q2 2024

2024 120 pages

This report provides a comprehensive view of the attitudes of installers toward smart building solutions, specifically among electrical installers and their clients. In the report, you will find insights into the installers' experiences with installing smart products and the willingness of end users to invest in such solutions, as well as their motivations and pain points.

3,250 Euro

Special reports

European Sustainability Report 2024

2025 51 pages

This report provides in-depth insights based on triangulation of key market information and data as well as data from USP Marketing Consultancy’s key monitors that are carried out year in, year out. The focus of this report is on the most important stakeholders within the construction industry, namely architects, contractors, electrical and HVAC installers within The United Kingdom, The Netherlands, Belgium, Germany, Poland, France, Italy, and Spain.

3,950 Euro

Special reports

European Sustainability Report 2024

2024 51 pages

This report provides in-depth insights based on triangulation of key market information and data as well as data from USP Marketing Consultancy’s key monitors that are carried out year in, year out. The focus of this report is on the most important stakeholders within the construction industry, namely architects, contractors, electrical and HVAC installers within The United Kingdom, The Netherlands, Belgium, Germany, Poland, France, Italy, and Spain.

3,950 Euro