Market report

Do-it-for-me in Home Improvement market

Access the latest market reports on European home improvement trends and insights at USP Research. Stay informed on the latest industry data and analysis.

News I published 07 March 2024 I Reinier Zuydgeest

Do-it-for-me becoming more popular in the European home improvement market

In our most recent report of the European home improvement monitor (Q4 2023 DIY vs DIFM), a notable shift in consumer behaviour towards the preference for professional services, termed as the “do it for me” trend, which is gaining momentum despite certain demographic and economic challenges.

Traditionally, the do-it-yourself (DIY) approach has been a prevalent choice among homeowners, driven by factors such as cost-saving measures and personal satisfaction in tackling home projects independently. However, recent observations indicate a departure from this trend, marked by an increasing inclination towards seeking professional assistance for home improvement endeavors.

One prominent factor contributing to this shift is the aging population. Contrary to expectations, older generations have displayed a remarkable resilience in continuing to engage in DIY activities. Nonetheless, as individuals advance in age, physical limitations may render them unable to undertake certain tasks independently, necessitating the involvement of skilled professionals. Consequently, the older demographic segment has emerged as a significant catalyst for the rise of the “do it for me” ethos.

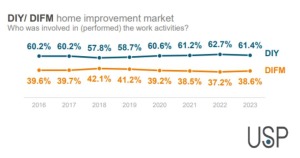

The year 2023 witnessed a pivotal moment in this evolving narrative, with statistics indicating a notable decrease in the share of DIY projects in the total job mix compared to previous years. The proportion of DIY projects declined from 62.7% in 2022 to 61.4% in 2023, while the share of “do it for me” experienced a corresponding increase, rising from 37.2% to 38.6%. This reversal marks the first time since 2019 that the trend towards professional services has shown a tangible upward trajectory.

Several factors underpin this resurgence of the “do it for me” mindset. The aging demographic is a primary driver, as individuals recognize the practical necessity of outsourcing tasks that surpass their physical capabilities. Additionally, the aftermath of the COVID-19 pandemic has reshaped consumer behaviours, prompting a surge in DIY efforts, particularly in minor decorative projects. As consumers gradually exhaust these smaller tasks, attention is shifting towards more extensive and intricate home renovations, a domain where professional expertise is often indispensable.

Moreover, there is a discernible trend towards enhancing the sustainability of residential properties. Whether through passive measures such as improved insulation or active interventions like upgrading installations, the pursuit of sustainability is increasingly becoming a priority for homeowners. Such endeavors typically necessitate specialized knowledge and technical proficiency, leading homeowners to enlist the services of professionals.

Despite the burgeoning demand for professional services, the construction and installation sector in Europe faces a formidable challenge in the form of labor shortages. This scarcity of skilled workers poses a significant constraint on the pace of transition towards the “do it for me” paradigm. As labor costs escalate due to the imbalance between supply and demand, the anticipated shift may unfold gradually, with potential reversals prompted by economic dynamics.

In conclusion, the evolving dynamics of home improvement underscore a nuanced interplay between demographic shifts, consumer preferences, and market realities. While the ascent of the “do it for me” trend signals a departure from last years where the share of DIY in the total job mix was increasing, its trajectory is tempered by practical considerations and economic constraints.

Home Improvement Consulting Services for You

We provide tailor-made market research and off-the-shelf reports, both B2B & B2C, qualitative and quantitative. Here are some you might be interested in

Monitor and improve client relationships to drive loyalty and repeat business in construction.

Map out key interactions and pain points to refine the overall construction experience.

Identify the aspects of service or product that most impact satisfaction in construction projects.

Read more

18 July 2024 I Dirk Hoogenboom

Willingness to invest of European consumers in sustainability improvements of their houses lower in 2024 than in 2023

17 January 2024 I Dirk Hoogenboom

European consumers are almost evenly split in their preferences for private labels vs A-Brands for home improvement products

15 January 2024 I Reinier Zuydgeest

Consumers continue to have a more positive opinion about private labels for home improvement products

06 December 2023 I Dirk Hoogenboom

The Impact Of The Pandemic On The Home Improvement Market

Fresh Insights Await

Our relevant reports

Delve into the newest findings across various market segments, crafted for a cutting-edge overview. Explore our insightful reports, brimming with up-to-date data, trend analyses, and in-depth examinations, all tailored to provide you with a comprehensive understanding of the current market dynamics.

Construction

Home Improvement

Installation

Special reports

Construction

Smart Materials and Buildings Q4 2024

2024 85 pages

Explore the evolving future in construction sector among European architects in Q4 2024. Delve into the factors driving material preferences and the impact on construction aesthetics and sustainability.

2,000 Euro

Construction

Digitalisation and BIM H2 2024

2025 64 pages

Uncover the preferred purchase channels of contractors in H2 2024, and understand how purchasing behaviors evolved. This report provides insights into the factors influencing purchasing decisions among contractors.

6,000 Euro

Construction

Decision making process Q3 2024

2024 87 pages

Unveil the decision-making processes in the construction industry through the lens of European architects. Discover the factors that influence crucial decisions and the interplay among different stakeholders.

2,000 Euro

Construction

Prefab H1 2024

2024 63 pages

Discover the adoption rate and benefits of prefabrication technology among European contractors in H1 2024. Understand the driving forces behind prefab usage and its impact on project efficiency and cost-saving.

6,000 Euro

Construction

Future of construction Q2 2024

2024 82 pages

Explore the evolving future in construction sector among European architects in Q2 2024. Delve into the factors driving material preferences and the impact on construction aesthetics and sustainability.

2,000 Euro

Construction

Sustainability 2024

2024 72 pages

Painter Insight Monitor 2024 will focus on understanding the specific needs, preferences, and challenges faced by painters when it comes to sustainable products.

11,000 Euro

Home Improvement

DIY vs DIFM Q4 2024

2025 76 pages

Explore the prevailing trends between DIY and DIFM in Q4 2024. Understand consumer preferences and the factors influencing their choice between DIY and DIFM.

3,500 Euros

Home Improvement

Branding Q3 2024

2024 74 pages

Discover the power of branding in the home improvement sector. Explore how strong branding influences consumer preferences and purchase decisions.

3,500 Euro

Home Improvement

European Garden Monitor

2023 43 pages

Explore the European Garden Monitor, a comprehensive platform dedicated to garden health monitoring in Europe. Access valuable resources and expert advice today.

12,000 Euro

Home Improvement

Purchase channels Q2 2024

2024 90 pages

The European Home Improvement Monitor offers valuable insights on purchase channels in the European home improvement industry, examining the evolving preferences and behaviors of consumers across traditional retail and emerging online platforms.

3,500 Euro

Home Improvement

Sustainability Q1 2024

2024 81 pages

Delve into sustainability trends in the home improvement sector in Q1 2024. Discover consumer preferences and the shift towards eco-friendly home improvement solutions.

3,500 Euro

Home Improvement

DIY versus DIFM Q4 2021

2024 113 pages

This report is a must-have if you’re in the home improvement industry. It provides a wealth of information on the behaviour of DIY and DIFM consumers, their motivations, and the factors that influence their purchasing decisions.

3,150 Euro

Installation

Training needs Q1 2025

2025 100 pages

This report offers an overview of installers’ habits and preferences concerning their education. Furthermore, the report encompasses the pervasive challenge of workforce shortage and explores the sector’s strategies for resolving this issue.

3,250 Euro

Installation

Media orientation Q4 2024

2025 128 pages

The European Mechanical Installation Monitor report provides a detailed analysis of the plumbing and HVAC industry. This report specifically focuses on Media Orientation in the industry.

2,800 Euro

Installation

Services in the installation sector Q4 2024

2025 102 pages

This report provides a comprehensive view of the installer's requirements for services from manufacturers. Within the report, you will find information on the most needed services in each category: commercial processes, engineering, products & installation, and repair & maintenance. It also examines the services that installers offer to their customers.

3,250 Euro

Installation

Prefab Q3 2024

2024 110 pages

Uncover the adoption of prefabricated products in HVAC installations during Q2 2022. Delve into the benefits and challenges associated with prefabrication in HVAC.

2,800 Euro

Installation

Prefab Q3 2024

2024 119 pages

This report offers a comprehensive view of the installers’ involvement and needs regarding prefabricated electrical installations.

3,250 Euro

Installation

Smart & Connected Products Q2 2024

2024 120 pages

This report provides a comprehensive view of the attitudes of installers toward smart building solutions, specifically among electrical installers and their clients. In the report, you will find insights into the installers' experiences with installing smart products and the willingness of end users to invest in such solutions, as well as their motivations and pain points.

3,250 Euro

Special reports

European Sustainability Report 2024

2025 51 pages

This report provides in-depth insights based on triangulation of key market information and data as well as data from USP Marketing Consultancy’s key monitors that are carried out year in, year out. The focus of this report is on the most important stakeholders within the construction industry, namely architects, contractors, electrical and HVAC installers within The United Kingdom, The Netherlands, Belgium, Germany, Poland, France, Italy, and Spain.

3,950 Euro

Special reports

European Sustainability Report 2024

2024 51 pages

This report provides in-depth insights based on triangulation of key market information and data as well as data from USP Marketing Consultancy’s key monitors that are carried out year in, year out. The focus of this report is on the most important stakeholders within the construction industry, namely architects, contractors, electrical and HVAC installers within The United Kingdom, The Netherlands, Belgium, Germany, Poland, France, Italy, and Spain.

3,950 Euro