Market report

The future of construction industry

Gain valuable insights into the European architectural landscape with the European Architectural Barometer market reports. Stay informed on trends and forecasts relevant to architects with this resource.

News I published 24 September 2024 I Dirk Hoogenboom

Future Developments in Construction Still Far Away

Even though the construction industry is undergoing significant change, the path towards embracing cutting-edge tech remains slow. What, then, dominates the conversation? How long can we afford to prioritize traditional methods over the potential of emerging technologies (A.I, blockchain, robotics, IoT…)? And how soon can we expect to see widespread integration in construction projects?

All this – and more – we covered in Q2 2024 European Architectural Barometer Report, taking a close look into solutions that will greatly impact the industry. Published in August, the report features insights across 8 European countries, outlining the upcoming focus of architects.

Sustainability First, Innovation Later

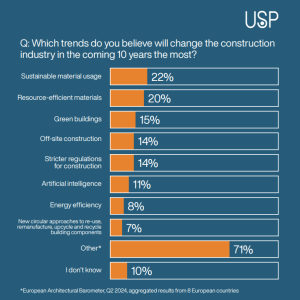

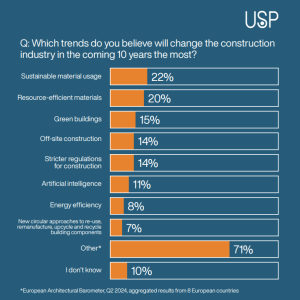

The construction industry is, we well know, notoriously traditional and slow to adapt. When asked about what’s driving the industry, architects think about brassbound trends: it’s all about sustainability (22%), resource-efficient materials (20%) and off-site construction (14%), with innovative technology having yet to gain traction. A.I. was, for instance, ranked 6th in terms of anticipated trends, with only a shy 11% mentioning it spontaneously. While our stats show 6-7 spiking trends that will shape a decade of construction, it’s important to note that many architects – some 70% of them when prompted – also mention other factors than the ones included in the overview.

Advanced Technologies Taking A Backseat

Despite the buzz surrounding A.I, drone tech, nanotech, augmented reality, robotization, blockchain, 3D-prints… architects are keeping them on the sidelines. On a wider scale, most are overwhelmingly ignored, with only IoT ranking 6th in ongoing projects (with 29% of all European architects mentioning that this is already strongly or very strongly considered in their projects). The trends preceding it are stricter regulations (61%), green buildings (55%) and off-site construction (37%). Adoption rates for the rest – say, blockchain, robotization and nanotech – seem far down the line, with over 50% of architects claiming, when prompted directly, not to consider them at all.

Timeline for Integration

As far as how long will take, the expectancy is late. The majority of architects don’t really see advanced technologies implemented in the near future. Generally speaking, we do see certain elements either happening or happening in the next three years: drones, IoT, A.R. and A.I. But they are vastly overshadowed by green buildings (57%), off-site construction (54%) and lower on-site garbage production (46%). For comparison, blockchain, robotization and nanotech span 10% – 14%, meaning more advanced trends will come up in the next ten years.

Conclusion

The European Architectural Barometer underscores that sustainability continues to lead the conversation and more disruptive technologies – though highly anticipated – still have a long road ahead before becoming commonplace in the construction industry.

Construction Consulting Services for You

We provide tailor-made market research and off-the-shelf reports, both B2B & B2C, qualitative and quantitative. Here are some you might be interested in

Monitor and improve client relationships to drive loyalty and repeat business in construction.

Map out key interactions and pain points to refine the overall construction experience.

Identify the aspects of service or product that most impact satisfaction in construction projects.

Read more

12 December 2024 I Dirk Hoogenboom

Buying Behavior of Handymen

12 December 2024 I Henri Busker

Handymen Radar – Private Labels vs. Branded Products

12 December 2024 I Dirk Hoogenboom

Sustainability and Painting – What Matters Most?

12 December 2024 I Zeynep Kutsal

Are European Painters Getting Younger?

Fresh Insights Await

Our relevant reports

Delve into the newest findings across various market segments, crafted for a cutting-edge overview. Explore our insightful reports, brimming with up-to-date data, trend analyses, and in-depth examinations, all tailored to provide you with a comprehensive understanding of the current market dynamics.

Construction

Home Improvement

Installation

Special reports

Construction

Smart Materials and Buildings Q4 2024

2024 85 pages

Explore the evolving future in construction sector among European architects in Q4 2024. Delve into the factors driving material preferences and the impact on construction aesthetics and sustainability.

2,000 Euro

Construction

Digitalisation and BIM H2 2024

2025 64 pages

Uncover the preferred purchase channels of contractors in H2 2024, and understand how purchasing behaviors evolved. This report provides insights into the factors influencing purchasing decisions among contractors.

6,000 Euro

Construction

Decision making process Q3 2024

2024 87 pages

Unveil the decision-making processes in the construction industry through the lens of European architects. Discover the factors that influence crucial decisions and the interplay among different stakeholders.

2,000 Euro

Construction

Prefab H1 2024

2024 63 pages

Discover the adoption rate and benefits of prefabrication technology among European contractors in H1 2024. Understand the driving forces behind prefab usage and its impact on project efficiency and cost-saving.

6,000 Euro

Construction

Future of construction Q2 2024

2024 82 pages

Explore the evolving future in construction sector among European architects in Q2 2024. Delve into the factors driving material preferences and the impact on construction aesthetics and sustainability.

2,000 Euro

Construction

Sustainability 2024

2024 72 pages

Painter Insight Monitor 2024 will focus on understanding the specific needs, preferences, and challenges faced by painters when it comes to sustainable products.

11,000 Euro

Home Improvement

DIY vs DIFM Q4 2024

2025 76 pages

Explore the prevailing trends between DIY and DIFM in Q4 2024. Understand consumer preferences and the factors influencing their choice between DIY and DIFM.

3,500 Euros

Home Improvement

Branding Q3 2024

2024 74 pages

Discover the power of branding in the home improvement sector. Explore how strong branding influences consumer preferences and purchase decisions.

3,500 Euro

Home Improvement

European Garden Monitor

2023 43 pages

Explore the European Garden Monitor, a comprehensive platform dedicated to garden health monitoring in Europe. Access valuable resources and expert advice today.

12,000 Euro

Home Improvement

Purchase channels Q2 2024

2024 90 pages

The European Home Improvement Monitor offers valuable insights on purchase channels in the European home improvement industry, examining the evolving preferences and behaviors of consumers across traditional retail and emerging online platforms.

3,500 Euro

Home Improvement

Sustainability Q1 2024

2024 81 pages

Delve into sustainability trends in the home improvement sector in Q1 2024. Discover consumer preferences and the shift towards eco-friendly home improvement solutions.

3,500 Euro

Home Improvement

DIY versus DIFM Q4 2021

2024 113 pages

This report is a must-have if you’re in the home improvement industry. It provides a wealth of information on the behaviour of DIY and DIFM consumers, their motivations, and the factors that influence their purchasing decisions.

3,150 Euro

Installation

Training needs Q1 2025

2025 100 pages

This report offers an overview of installers’ habits and preferences concerning their education. Furthermore, the report encompasses the pervasive challenge of workforce shortage and explores the sector’s strategies for resolving this issue.

3,250 Euro

Installation

Media orientation Q4 2024

2025 128 pages

The European Mechanical Installation Monitor report provides a detailed analysis of the plumbing and HVAC industry. This report specifically focuses on Media Orientation in the industry.

2,800 Euro

Installation

Services in the installation sector Q4 2024

2025 102 pages

This report provides a comprehensive view of the installer's requirements for services from manufacturers. Within the report, you will find information on the most needed services in each category: commercial processes, engineering, products & installation, and repair & maintenance. It also examines the services that installers offer to their customers.

3,250 Euro

Installation

Prefab Q3 2024

2024 110 pages

Uncover the adoption of prefabricated products in HVAC installations during Q2 2022. Delve into the benefits and challenges associated with prefabrication in HVAC.

2,800 Euro

Installation

Prefab Q3 2024

2024 119 pages

This report offers a comprehensive view of the installers’ involvement and needs regarding prefabricated electrical installations.

3,250 Euro

Installation

Smart & Connected Products Q2 2024

2024 120 pages

This report provides a comprehensive view of the attitudes of installers toward smart building solutions, specifically among electrical installers and their clients. In the report, you will find insights into the installers' experiences with installing smart products and the willingness of end users to invest in such solutions, as well as their motivations and pain points.

3,250 Euro

Special reports

European Sustainability Report 2024

2025 51 pages

This report provides in-depth insights based on triangulation of key market information and data as well as data from USP Marketing Consultancy’s key monitors that are carried out year in, year out. The focus of this report is on the most important stakeholders within the construction industry, namely architects, contractors, electrical and HVAC installers within The United Kingdom, The Netherlands, Belgium, Germany, Poland, France, Italy, and Spain.

3,950 Euro

Special reports

European Sustainability Report 2024

2024 51 pages

This report provides in-depth insights based on triangulation of key market information and data as well as data from USP Marketing Consultancy’s key monitors that are carried out year in, year out. The focus of this report is on the most important stakeholders within the construction industry, namely architects, contractors, electrical and HVAC installers within The United Kingdom, The Netherlands, Belgium, Germany, Poland, France, Italy, and Spain.

3,950 Euro