Market report

Digital media among Painters

Gain valuable insights into the painter industry with the Painter Insight Monitor market report from USP Research. Stay informed and make data-driven decisions for your business.

News I published 20 June 2022 I Dirk Hoogenboom

Digital media are becoming more important to reach European painters

Painters can be quite traditional, for instance in the ways and channels through which they acquire information and inspiration. Be that as it may, the population of painters is constantly evolving and developing, not only due to market trends like sustainability or labour shortages, but also due to the progress of time itself. While the oldest of painters are leaving the market for a well-earned retirement, younger generations of painters slowly but steadily take over their positions.

Due to these generational shifts, the media orientation behaviour of the average painter may change. That may have implications for the effectiveness of current and future marketing strategies of manufacturers and brands of paint and paint-related products. That is why USP Marketing Consultancy constantly monitors the developments of painters in 11 European markets, and why we made media orientation the theme topic of the 2022 Painter Insight Monitor.

Traditional media are still dominant

Whether it is to find information on products and applications or to find inspiration, the media channel European painters use the most are websites. However, traditional media sources like staff and information at the purchase point, sales representatives, colleagues and trade magazines are still dominant when taken together. Compared to that, digital sources like the internet and social media are used less. In that sense, the media orientation of the average European painter is indeed quite traditional.

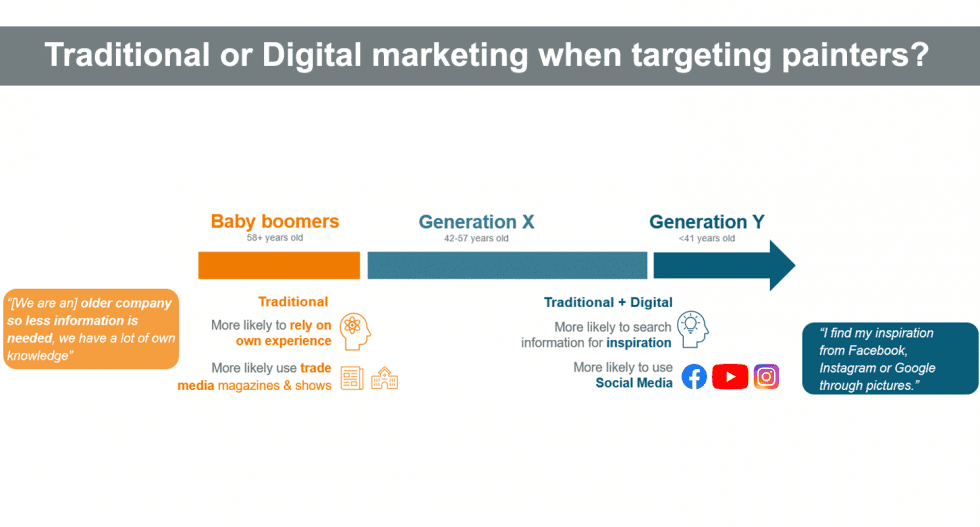

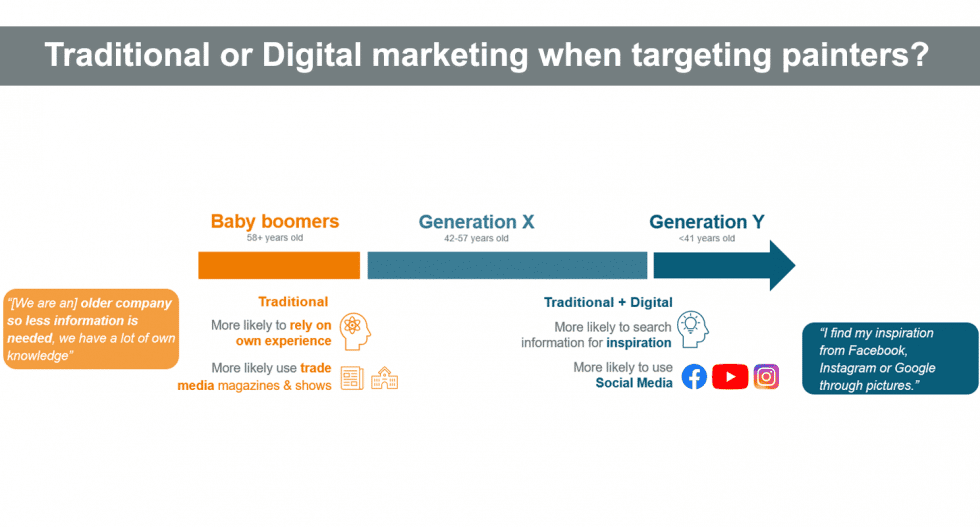

However, as we have seen in last year’s monitor on segmentation of European painters, it may not be wise to base a marketing strategy on the average painter, as there is great diversity among the European population. That is also the case for media orientation of painters. When looking at media channels used by different generations of painters, for instance, an impending shift in media orientation appears.

Younger generations use more digital media

As the above image illustrates, the oldest generation of painters predominantly use traditional sources and tend to rely more on their experience, not just to find necessary information but also for inspiration. Younger generations do not have as much experience to rely on, however, and make more use of both traditional and digital sources of information and especially for inspiration.

Of all digital sources available, younger generations of painters increasingly use social media or images found through search engines for inspiration for their paint jobs. In fact, generation Y finds social media like facebook, pinterest, youtube and Instagram more important than websites of wholesalers.

Multichannel approach is the way to go

Despite a still increasing average age of European painters, the unstoppable force of time will make generation X and Y more predominant in years to come. Online presence is already a good item to include in a marketing strategy aimed at European painters, but including social media campaigns in the overall strategy is bound to pay off in the long run.

As younger generations of painters make more use of social media for inspiration and older generations use the more traditional channels for their information needs, it is clear that for now, an omnichannel approach is the way to go. However, just like there are differences between generations, there can be vast differences between media orientation behaviour of painters in different countries. For a full overview we refer you to USP Marketing Consultancy’s 2022 Painter Insight Monitor