Market report

HVAC installation insights and advice

Gain valuable insights into the European mechanical installation monitor market with USP Research's market report. Learn about trends, drivers, and forecasts in this industry.

News I published 12 September 2022 I Dirk Hoogenboom

Despite the war in Ukraine, the European installation market is heating up

Despite the war in Ukraine, the European installation market is heating up

The start of 2022 was characterised by uncertainty, of which the Russian invasion of Ukraine was a major cause. Additionally, uncertainty in the construction and installation sector is being fed by ongoing supply chain issues and the accelerating of the energy transition. The question is what influence these factors have on the activity of installation companies?

That uncertainty and tension in the first quarter was indeed felt by many HVAC installers and plumbers, as is apparent in the results of USP Marketing Consultancy’s European Mechanical Installation Monitor. The interviews with installers from six European show that turnovers of installation companies declined somewhat in that first quarter.

Turnover balances mainly remained positive

Despite the decline, the turnover balance in Q1 was still positive in all countries except Poland, where after three positive quarters, the turnover balance tuned negative again. In a way this does not surprise, as Poland is closest to the war zone. The second quarter, turnovers of installation companies rose again, however. Although the turnover balance in Poland was still negative in Q2, turnover also increased there compared to Q1.

So in the second quarter turnovers were on the rise again, and installers’ expectations for the third quarter are even better. Despite the dip in Q1 and the negative balance in Poland, the war in Ukraine seems to have little impact on the installation companies. That is more or less in line with our forecasts for the entire construction and installation sector. They show that growth in these sectors will slow down a bit, but growth is expected still.

Order books of installers are on the rise

Especially in the installation sector, the quest for sustainability and the energy transition are important drivers. Both come with a need for new installations in buildings and consequently boost the installation sector. The energy crisis caused by the war is putting even greater pressure on the transition to sustainable energy sources. The result is even more work for installers, which is also reflected by their order books.

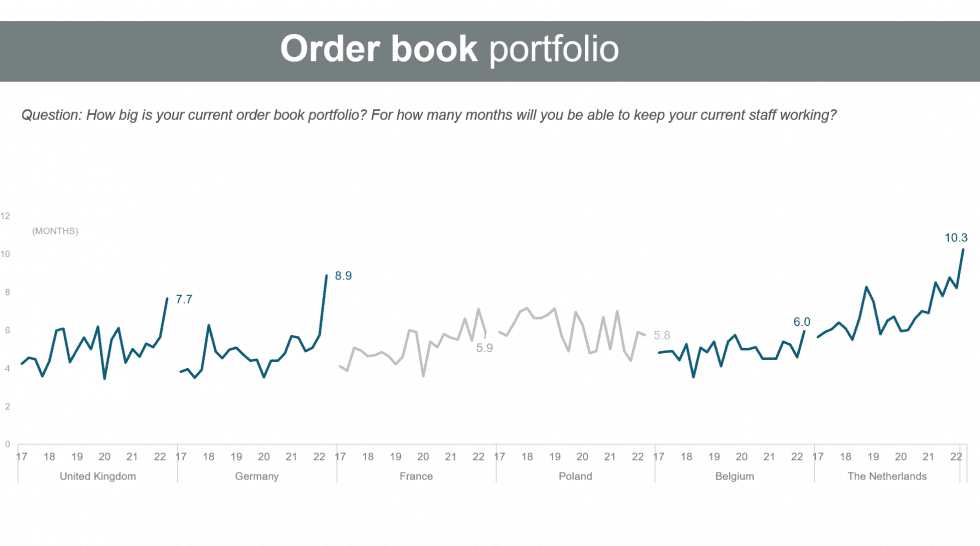

As the graphs show, order books suddenly increased a lot in four of the six countries in the second quarter. Dutch installers are busiest, with on average a whopping 10,3 months of work scheduled. In Germany and the UK, order books are also at an all-time high, with an average 8,9 and 7,7 months respectively. The only places where order books declined were in France and Poland, but even there installers have about six months of work planned on average.

Small influence on many trends

So what exactly is the impact of the war in Ukraine on the European installation sector? Looking at turnovers, aside from a slight dip in Q1, that impact is quite limited. In the whole European construction and installation sector, we see pretty much the same: lower growth but growth nonetheless. From this perspective, the impact of the war in Ukraine on these sectors is rather small.

Looking at order books, installers are a lot busier all of a sudden, but that is not just caused by the war in Ukraine and the resulting energy shortages. Sustainability and the energy transition have been strong trends for quite some time now, and their influence is increasing due to increased visibility of climate change. More than before, initiatives and climate policies like for instance the European Green Deal are implemented, which also cause installers’ agendas to get busier.

In this context, the war in Ukraine and consequent energy crisis are like a fly hitting the web of trend in the installation market. Although the impact seems small, the war does have some influence on all those trends. The energy transition is accelerated, causing installers to be busier. That in turn influences impacts other trends, like labour and material shortages, and in that manner the tremor travels the entire web. In any case, installation companies need not worry about a shortage of work any time soon.

For more information on the development of installation companies in six major European markets, we refer you to the Q2 2022 report of USP Marketing Consultancy’s European Mechanical Installation Monitor.

Read more

31 July 2024 I Dirk Hoogenboom

How is the smart and connected products market evolving in Europe?

02 July 2024 I Dirk Hoogenboom

BIM adoption among European HVAC installers remains low

06 June 2024 I Maja Markovic

Sustainability in the electrical installation sector; slow but steady growth

10 May 2024 I Dirk Hoogenboom

Sustainability in the electrical installation industry

Fresh Insights Await

Our relevant reports

Delve into the newest findings across various market segments, crafted for a cutting-edge overview. Explore our insightful reports, brimming with up-to-date data, trend analyses, and in-depth examinations, all tailored to provide you with a comprehensive understanding of the current market dynamics.

Construction

Home Improvement

Installation

Special reports

Construction

Smart Materials and Buildings Q4 2024

2024 85 pages

Explore the evolving future in construction sector among European architects in Q4 2024. Delve into the factors driving material preferences and the impact on construction aesthetics and sustainability.

2,000 Euro

Construction

Digitalisation and BIM H2 2024

2025 64 pages

Uncover the preferred purchase channels of contractors in H2 2024, and understand how purchasing behaviors evolved. This report provides insights into the factors influencing purchasing decisions among contractors.

6,000 Euro

Construction

Decision making process Q3 2024

2024 87 pages

Unveil the decision-making processes in the construction industry through the lens of European architects. Discover the factors that influence crucial decisions and the interplay among different stakeholders.

2,000 Euro

Construction

Prefab H1 2024

2024 63 pages

Discover the adoption rate and benefits of prefabrication technology among European contractors in H1 2024. Understand the driving forces behind prefab usage and its impact on project efficiency and cost-saving.

6,000 Euro

Construction

Future of construction Q2 2024

2024 82 pages

Explore the evolving future in construction sector among European architects in Q2 2024. Delve into the factors driving material preferences and the impact on construction aesthetics and sustainability.

2,000 Euro

Construction

Sustainability 2024

2024 72 pages

Painter Insight Monitor 2024 will focus on understanding the specific needs, preferences, and challenges faced by painters when it comes to sustainable products.

11,000 Euro

Home Improvement

DIY vs DIFM Q4 2024

2025 76 pages

Explore the prevailing trends between DIY and DIFM in Q4 2024. Understand consumer preferences and the factors influencing their choice between DIY and DIFM.

3,500 Euros

Home Improvement

Branding Q3 2024

2024 74 pages

Discover the power of branding in the home improvement sector. Explore how strong branding influences consumer preferences and purchase decisions.

3,500 Euro

Home Improvement

European Garden Monitor

2023 43 pages

Explore the European Garden Monitor, a comprehensive platform dedicated to garden health monitoring in Europe. Access valuable resources and expert advice today.

12,000 Euro

Home Improvement

Purchase channels Q2 2024

2024 90 pages

The European Home Improvement Monitor offers valuable insights on purchase channels in the European home improvement industry, examining the evolving preferences and behaviors of consumers across traditional retail and emerging online platforms.

3,500 Euro

Home Improvement

Sustainability Q1 2024

2024 81 pages

Delve into sustainability trends in the home improvement sector in Q1 2024. Discover consumer preferences and the shift towards eco-friendly home improvement solutions.

3,500 Euro

Home Improvement

DIY versus DIFM Q4 2021

2024 113 pages

This report is a must-have if you’re in the home improvement industry. It provides a wealth of information on the behaviour of DIY and DIFM consumers, their motivations, and the factors that influence their purchasing decisions.

3,150 Euro

Installation

Training needs Q1 2025

2025 100 pages

This report offers an overview of installers’ habits and preferences concerning their education. Furthermore, the report encompasses the pervasive challenge of workforce shortage and explores the sector’s strategies for resolving this issue.

3,250 Euro

Installation

Media orientation Q4 2024

2025 128 pages

The European Mechanical Installation Monitor report provides a detailed analysis of the plumbing and HVAC industry. This report specifically focuses on Media Orientation in the industry.

2,800 Euro

Installation

Services in the installation sector Q4 2024

2025 102 pages

This report provides a comprehensive view of the installer's requirements for services from manufacturers. Within the report, you will find information on the most needed services in each category: commercial processes, engineering, products & installation, and repair & maintenance. It also examines the services that installers offer to their customers.

3,250 Euro

Installation

Prefab Q3 2024

2024 110 pages

Uncover the adoption of prefabricated products in HVAC installations during Q2 2022. Delve into the benefits and challenges associated with prefabrication in HVAC.

2,800 Euro

Installation

Prefab Q3 2024

2024 119 pages

This report offers a comprehensive view of the installers’ involvement and needs regarding prefabricated electrical installations.

3,250 Euro

Installation

Smart & Connected Products Q2 2024

2024 120 pages

This report provides a comprehensive view of the attitudes of installers toward smart building solutions, specifically among electrical installers and their clients. In the report, you will find insights into the installers' experiences with installing smart products and the willingness of end users to invest in such solutions, as well as their motivations and pain points.

3,250 Euro

Special reports

European Sustainability Report 2024

2025 51 pages

This report provides in-depth insights based on triangulation of key market information and data as well as data from USP Marketing Consultancy’s key monitors that are carried out year in, year out. The focus of this report is on the most important stakeholders within the construction industry, namely architects, contractors, electrical and HVAC installers within The United Kingdom, The Netherlands, Belgium, Germany, Poland, France, Italy, and Spain.

3,950 Euro

Special reports

European Sustainability Report 2024

2024 51 pages

This report provides in-depth insights based on triangulation of key market information and data as well as data from USP Marketing Consultancy’s key monitors that are carried out year in, year out. The focus of this report is on the most important stakeholders within the construction industry, namely architects, contractors, electrical and HVAC installers within The United Kingdom, The Netherlands, Belgium, Germany, Poland, France, Italy, and Spain.

3,950 Euro