year

2021

No. of pages

113

Target group

Consumers

Key research topics

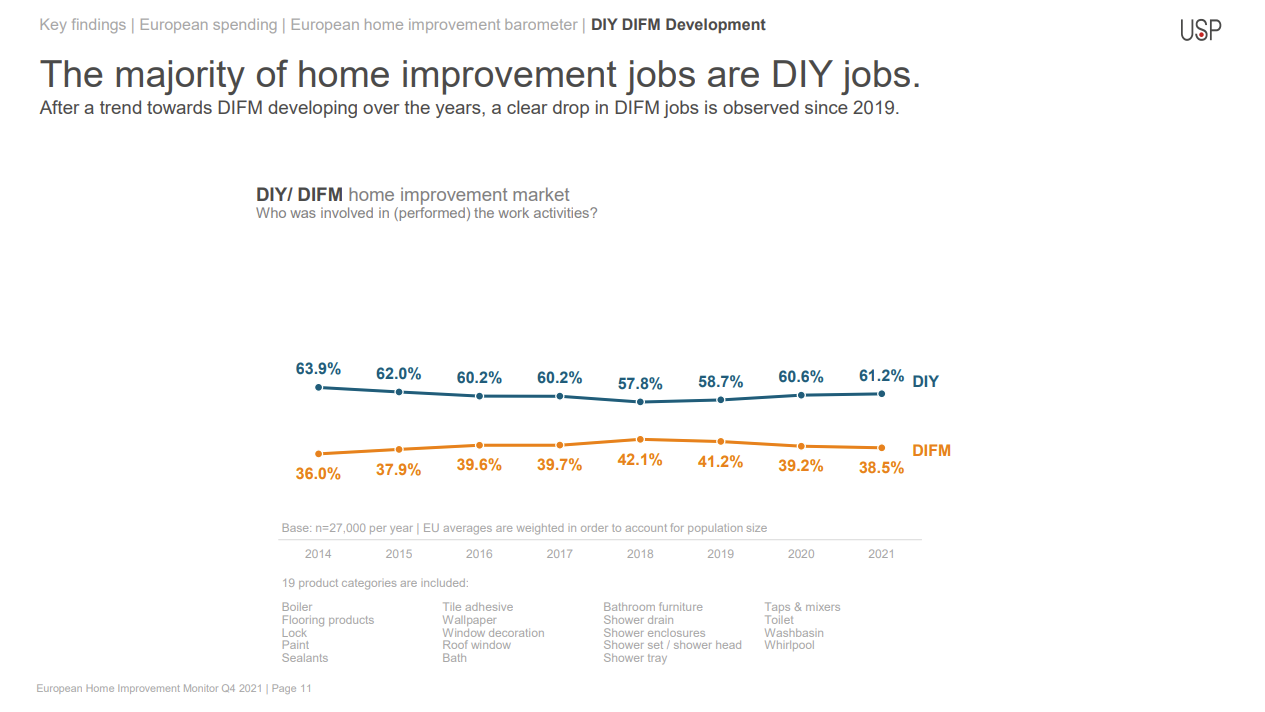

DIY versus DIFM

Methodology

Based on 6.667 successful online interviews in native languages

Country scope

Germany, the United Kingdom, France, Netherlands, Belgium, Poland, Spain, Italy, Denmark, Sweden and Austria

Deliverables

Full report in pdf or ppt covering all 11 countries, support from a key account manager in case of questions

Publication frequency

Quarterly

Price

3,150 Euro

What is this report?

This report provides a comprehensive overview of the home improvement industry, specifically tailored to European consumers. Within this report, you will gain insights into how customers perceive improvements in their households, their primary motivations, and the significance of sustainability in their decisions. This report not only looks at Do It Yourself (DIY) versus Do It For Me (DIFM), but we also look closely at the planned and expected home improvement jobs that consumers will have. Additionally, the report delves into the economic landscape of the home improvement sector. This data can assist you in refining, enhancing, or developing your business, communication, and marketing strategies for the DIY consumer market in Europe. Our research is based on online interviews conducted with 6,667 European consumers hailing from Germany, the United Kingdom, France, the Netherlands, Belgium, Poland, Spain, Italy, Denmark, Sweden, and Austria.

Why do you need this report?

This report aims to provide insights into how European consumers prefer to undertake their home improvement projects: whether they choose to hire a professional or do it themselves (DIY vs. DIFM). These insights are of significant importance for DIY stores and manufacturers targeting European customers in this market. With this information at their disposal, businesses can refine their marketing and communication strategies to better engage with their customers. Additionally, understanding the behaviour, preferences, and attitudes of customers in the context of home improvement will facilitate data-driven internal discussions, reducing the need for customized research.

How was the research conducted?

This report is based on 6.667 successful online interviews with consumers in European countries: Germany, the United Kingdom, France, Netherlands, Belgium, Poland, Spain, Italy, Denmark, Sweden and Austria. This research is conducted quarterly with the reports covering different key topics in the home improvement industry like media orientation, DIFM vs. DIY, sustainability, branding, digitalisation of the sector, purchase channels and many more.

What is included in this report?

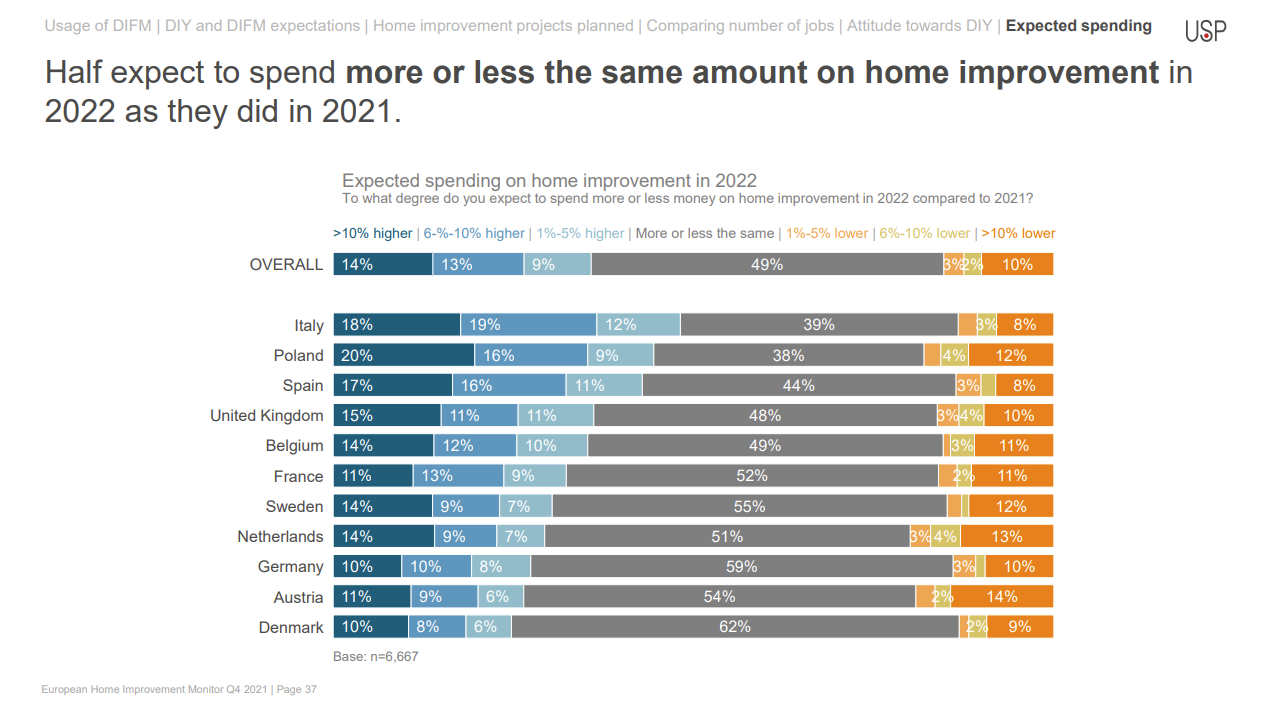

The primary aim of this research is to provide insights into the willingness of European consumers to undertake home improvement projects by themselves versus hiring professionals. The research uncovers their readiness to invest in home improvement projects, the amount they are willing to spend, and which generation tends to invest more and seek professional help for their home improvement projects.

This extensive study aims to provide an in-depth understanding of the current landscape and emerging trends in the ever-evolving home improvement industry. Additionally, the research encompasses an economic analysis of the DIY sector, offering insights into the future behaviour of consumers in this context.

Key questions answered

Why is there an increase in European consumers planning to start home improvement projects in 2021?

Which generation among European consumers is more willing to hire professionals for home improvement jobs?

For which types of home improvement jobs do consumers hire professionals the most?

Depending on household income, which types of home improvement jobs are consumers willing to invest in?

What is the amount European consumers are willing to invest in home improvement projects in the near future?

Table of content

- Key insights

- European developments

- DIY vs. DIFM

- European overview

- Country overview

- Austria

- Belgium

- Denmark

- France

- Germany

- Italy

- The Netherlands

- Poland

- Spain

- Sweden

- The UK

- Home improvement per category

- Paint

- Adhesives

- Adhesives/glues

- Sealants

- Power tools

Frequently asked questions

-

To what extent do European households outsource professionals for home improvement jobs?

About half of the European households have outsourced one or more home improvement jobs in the past two years.

-

Which generation is more prone to outsourcing home improvement professionals among European consumers?

The youngest generation is more likely to outsource home improvement jobs.

-

What is the biggest reason European consumers outsource home improvement jobs?

The lack of skill is the most significant reason for consumers to expect to outsource projects more often in the next two years.

-

Why was there an increase in home improvement projects among European consumers in 2021?

Enjoying DIY is the most important reason for the expected increase in DIY.

-

For which types of home improvement projects do European consumers hire professionals the most?

Compared to decorative home improvement jobs, construction jobs, and sustainability improvement jobs are more likely to be outsourced to professionals.

Contact us

Send us a message

Please contact our office or fill in the contact form and our specialists will contact you.

PHONE

+31 10 2066900ADDRESS

Max Euwelaan 51

3062 MA Rotterdam